Protect Your Home and Your Wallet After a Storm

After a Texas storm, a roof insurance claim is often your next, unavoidable step. The sheer force of Gulf Coast weather can leave a trail of destruction, and for homeowners, the path to recovery can feel just as turbulent. With average payouts for wind and hail claims in Texas reaching $13,000, and full roof replacements often costing much more, the financial stakes are incredibly high. But the challenge isn’t just financial; it’s a battle against stress, confusing paperwork, and the fear of being taken advantage of. Navigating this process can be overwhelming, but understanding the key stages is your best defense against being underpaid or wrongfully denied. For homeowners in Sugar Land and the greater Houston area, having expert roofing solutions from a trusted, local partner isn’t just a convenience—it’s a crucial asset. Many homeowners, unfortunately, lose thousands of dollars by accepting an insurer’s first lowball offer, failing to document damage properly, or not understanding the fine print in their own policy.

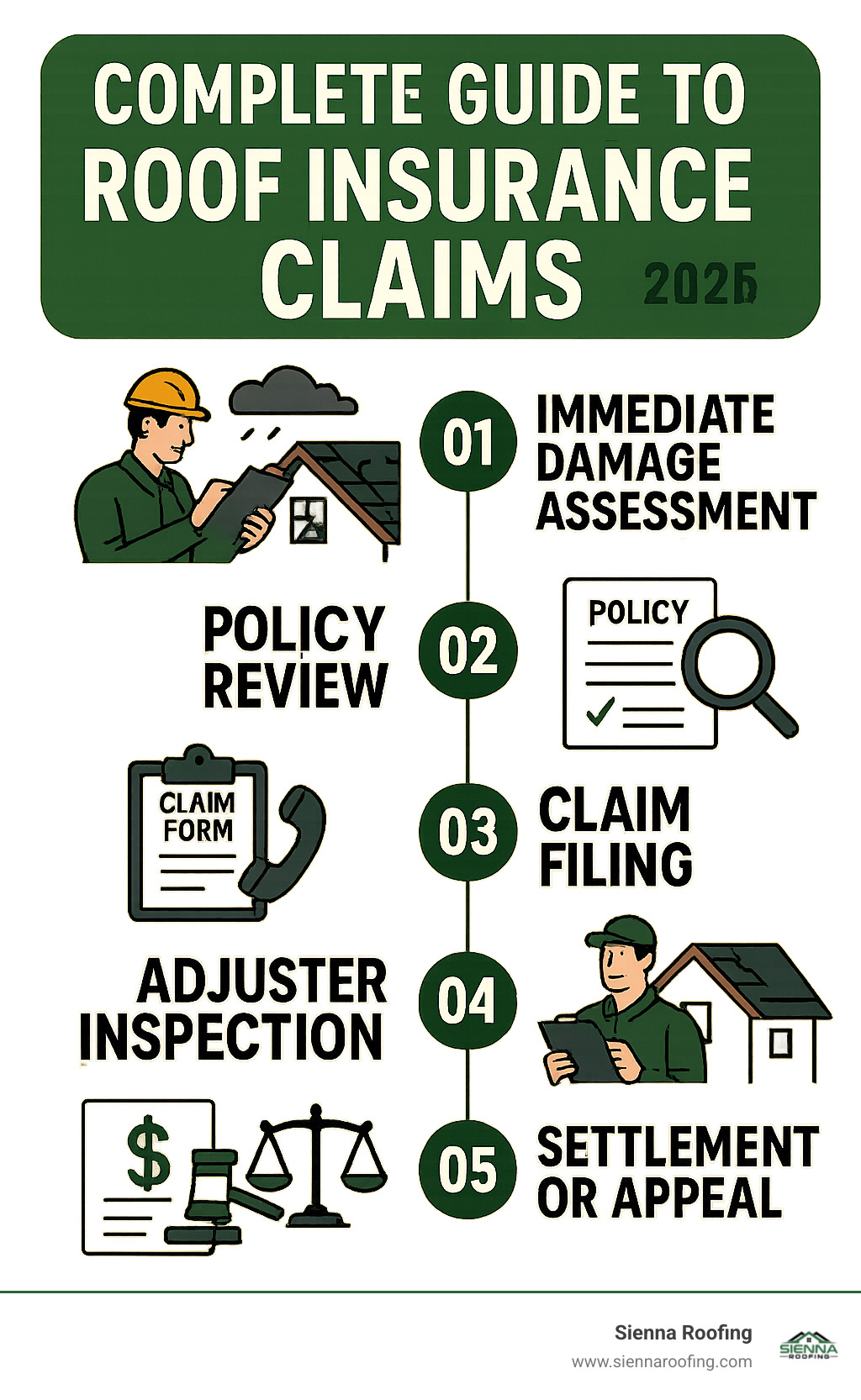

Key Stages of a Roof Insurance Claim:

- Immediate Damage Assessment & Documentation

- Policy Review (RCV vs. ACV) & Key Endorsements

- Claim Filing & Adjuster Inspection

- Settlement Negotiation, Supplements, or Appeal

As Andre Castro, CEO of Sienna Roofing, I’ve witnessed how a well-managed claim can transform a homeowner’s experience from one of anxiety to one of empowerment. My team is dedicated to being more than just roofers; we are advocates, committed to helping our neighbors successfully manage their roof insurance claim from the initial damage assessment to the final, fair settlement.

Step 1: What to Do Immediately After Roof Storm Damage

In the critical hours after a storm, your actions can significantly impact your roof insurance claim. First and foremost, ensure your family’s safety. Check for downed power lines, the smell of gas, or any signs of structural instability. If you have any doubts about your home’s safety, evacuate immediately. Once the area is secure, your priorities shift to documenting the damage and preventing it from worsening.

- Document Everything Carefully: Your smartphone is your most powerful tool. Take more photos and videos than you think you need, from every conceivable angle. Capture wide shots of each side of your house, then zoom in on specific damage points. Place a ruler or coin next to hail impacts to show scale. Don’t forget to document damage to gutters, window screens, siding, AC units, and fences. Inside, photograph any water stains on ceilings or walls. Create a simple damage log with the date, time, and a description of each photo.

- Prevent Further Damage (Mitigation): Your policy requires you to take “reasonable steps” to mitigate further harm. This typically means covering holes in your roof with a tarp or plywood to prevent water intrusion. This is a temporary fix, not a permanent repair. Save all receipts for materials like tarps and wood, as these costs are typically reimbursable under your claim. Failure to mitigate can give your insurer grounds to deny parts of your claim related to subsequent damage.

- Get a Professional Inspection First: Before you even call your insurance company, have a qualified, local roofing contractor inspect your roof. An experienced roofer can identify subtle but significant damage that an untrained eye—or even a busy insurance adjuster—might miss. This professional assessment provides a crucial baseline and strengthens your claim from the very beginning. For more details, see our guide on how to handle roof storm damage repair.

Identifying Insurance-Covered Damage vs. Normal Wear and Tear

Insurers only cover damage that is “sudden and accidental.” Distinguishing this from gradual deterioration is one of the most common points of contention in a roof insurance claim.

- Typically Covered (Sudden & Accidental):

- Wind Damage: Missing, creased, or lifted shingles from high winds (often 70+ mph). Look for a distinct pattern of damage.

- Hail Damage: Bruises or dents in the shingles (which may look like dark spots where granules are knocked off), cracked shingles, and damage to roof vents and soft metals.

- Fallen Debris: Damage from trees or large branches falling on the roof during a storm.

- Ice Dams: Damage caused by water backing up under shingles due to frozen gutters.

- Typically Not Covered (Gradual or Maintenance-Related):

- Normal Wear and Tear: General granule loss over time, sun-related cracking, or brittle shingles on an old roof.

- Lack of Maintenance: Clogged gutters causing water to back up, or failure to repair known small leaks.

- Pre-existing Issues: Damage that was present before the storm in question.

- Faulty Workmanship: Improper installation from a previous roofer that led to failure during the storm.

- Pest Damage: Issues caused by animals or insects.

Some policies also have exclusions for “cosmetic damage,” which is why a professional assessment is so valuable. For more details, you can learn more about what homeowners insurance covers.

Should You File a Claim? Understanding the Deductible Dilemma

Not all damage warrants filing a roof insurance claim. You must weigh the repair cost against your deductible. In Texas, many homeowners have a separate, higher deductible for wind and hail, often calculated as a percentage (e.g., 1% or 2%) of your home’s insured value. If your home is insured for $400,000, a 2% deductible is $8,000. If a professional estimate for repairs is $9,000, you would only receive $1,000 from the insurer. In that case, filing a claim might not be worth the potential impact on your future premiums or claims history. However, for a full roof replacement—averaging $15,000 to $25,000 in the Houston area—filing a claim is almost always essential.

Step 2: Understanding Your Roof Insurance Policy—RCV vs. ACV

Most homeowners don’t read their insurance policy until they need it, but this document holds the key to your financial recovery. Knowing your coverage before filing a roof insurance claim can save you thousands of dollars and immense frustration. Locate your policy’s “Declarations Page” to find your coverage limits and deductibles. In Texas, pay close attention to whether you have a standard (fixed-dollar) deductible or a percentage-based deductible for wind and hail, as the latter can be significantly higher.

Replacement Cost Value (RCV) vs. Actual Cash Value (ACV): The Critical Difference

This is the single most important factor determining your payout. It dictates whether you receive enough to install a brand-new roof or just a fraction of that cost.

| Feature | Replacement Cost Value (RCV) | Actual Cash Value (ACV) |

|---|---|---|

| Payout Basis | Pays to replace with new materials of similar quality, without deducting for depreciation. | Pays the depreciated value of your old roof. |

| Depreciation | Not applied to the final payout. You receive it after repairs are done (recoverable depreciation). | Subtracted from your payout. The older the roof, the less you get. |

| Out-of-Pocket | Your deductible. | Your deductible PLUS the depreciation amount. |

| Premium | Higher premiums. | Lower premiums. |

- RCV Explained: An RCV policy is designed to make you “whole” again. The insurer pays the full cost to replace your damaged roof with a new one of similar kind and quality, minus your deductible. This is typically done in two payments. The first check is for the Actual Cash Value (ACV) of your roof. The remaining amount, called “recoverable depreciation,” is paid to you in a second check after you submit an invoice proving the work has been completed.

- ACV Explained: An ACV policy only pays what your old roof was worth at the moment it was damaged. It’s like selling your 15-year-old car; you get what it’s worth today, not what you paid for it. For a $20,000 roof replacement on a 15-year-old roof with a 25-year lifespan, the insurer might calculate $12,000 in depreciation. After subtracting that and your $2,000 deductible, your insurance check would only be $6,000, leaving you to pay the remaining $14,000 out-of-pocket.

Beyond RCV vs. ACV: Critical Policy Endorsements

Your protection doesn’t stop at RCV or ACV. Look for these critical endorsements (add-ons) in your policy:

- Ordinance or Law Coverage: Building codes change over time. If your roof was built to an older code, a repair or replacement might legally require you to upgrade certain components (like decking or ventilation) to meet current standards. Standard policies often don’t cover these mandatory, code-required upgrades. Ordinance or Law coverage is an endorsement that helps pay for these extra costs.

- Matching Coverage: If only part of your roof is damaged, your insurer might only offer to pay to replace the damaged section. This can leave you with a mismatched, patchwork roof that lowers your home’s value. In Texas, insurers are generally required to pay for matching when it’s reasonably possible, but having a specific “matching” endorsement in your policy provides much stronger protection and avoids disputes.

Understanding these details is crucial. For more help identifying damage, see our guide on how to tell if roof needs repair from hail damage.

Step 3: The Ultimate Guide to Filing Your Roof Insurance Claim

Once you’ve assessed the damage, reviewed your policy, and decided to file, acting with precision and promptness is essential. Most insurance policies have strict deadlines for filing, and any delay can allow damage to worsen, potentially weakening your roof insurance claim.

- Contact Your Insurer Promptly: Call your insurance company’s claims hotline or your local agent to report the damage. Have your policy number, a description of the damage, and the “date of loss” (the date the storm occurred) ready.

- Get a Claim Number: This number is your unique identifier for this entire process. Write it down and use it in all future communications with the insurer.

- Schedule the Adjuster’s Inspection: The insurer will assign an adjuster to inspect the damage and estimate the cost of repairs. Their job is to evaluate the loss on behalf of the insurance company.

- Have Your Contractor Present: This is a non-negotiable, critical step for protecting your interests. An insurance adjuster is a generalist who may not be a roofing expert and can easily miss subtle but costly damage. Having your trusted roofing contractor present ensures a second set of expert eyes is on-site to advocate for a complete and accurate assessment. Your roofer can point out damage the adjuster might overlook and discuss the true scope of work required.

Preparing for the Adjuster’s Visit

Your goal during the inspection is to make sure the adjuster sees everything you and your contractor have identified. Be organized and professional.

- Have Documentation Ready: Print out your photos, damage log, and your contractor’s detailed estimate. Present this in an organized folder.

- Walk the Property Together: Walk with the adjuster and your contractor. Point out each area of concern. Let your contractor do most of the technical talking, as they speak the same language regarding roofing components and installation methods.

- Be Helpful, Not Demanding: A cooperative attitude goes a long way. Offer them a ladder or access, but avoid speculating on the cause of damage or making emotional statements. Stick to the facts you’ve documented.

How Sienna Roofing Supports Your Roof Insurance Claim

Navigating the claims process is complex, which is why we offer comprehensive insurance claim assistance. Our support is designed to level the playing field:

- Expert Damage Assessment: We conduct a thorough inspection, identifying all storm-related damage to your entire property, not just the obvious spots on the roof.

- Detailed, Insurance-Ready Estimates: We use Xactimate, the same industry-standard software that most insurance companies use. This creates a detailed, line-item estimate that adjusters recognize and trust, making it easier to justify every part of the claim.

- On-Site Advocacy: We meet with your adjuster on-site to review our findings, explain the necessity of each recommended repair, and ensure the scope of loss includes everything from code upgrades to proper ventilation.

For a complete overview of the process from an industry leader, you can download the steps for the storm restoration process.

Step 4: What to Do If Your Claim is Denied or Underpaid

A denied or underpaid roof insurance claim is a deeply frustrating setback, but it is not the final word. Many initial decisions are based on incomplete information and are successfully overturned on appeal. Understanding why your claim was rejected is the first step to fighting back effectively.

Common Reasons for Claim Denials or Low Offers

- Pre-existing Damage/Wear and Tear: The adjuster concluded the damage was old or due to lack of maintenance, not the recent storm.

- Insufficient Damage: The adjuster determined the damage was only cosmetic or did not meet the threshold to warrant a full replacement.

- Improper Installation: The adjuster blamed the roof’s failure on faulty workmanship from a previous installation.

- Policy Exclusions: The specific type of damage (e.g., cosmetic hail hits) is excluded by your policy language.

- Incomplete Estimate: The adjuster’s initial estimate missed key components, labor costs, or code-required items.

The Appeals Process: How to Fight Back

If you disagree with your insurer’s decision, you have the right to appeal. A systematic approach is your best strategy:

- Request the Denial in Writing: Never accept a verbal denial. Demand a formal letter that clearly outlines the specific reasons for the decision, citing the exact policy language they are using to justify it.

- Submit a Formal Appeal with New Evidence: This is where your professional contractor becomes your most valuable ally. We can provide a more detailed damage report, new photos, and an independent appraisal that directly counters the insurer’s reasons for denial. Your appeal letter should be professional and fact-based.

- Request a Second Inspection: You can request that a different, often more experienced, adjuster re-evaluate your property. Insist that your contractor be present during this second meeting to advocate on your behalf.

Contractor Assistance with Supplements

Often, a claim isn’t denied but is simply underpaid. The adjuster’s initial estimate is a starting point, not the final amount. A “supplement” is an additional claim for legitimate costs that were missed in the initial scope of work. Sienna Roofing specializes in identifying these gaps. We prepare and submit detailed supplement requests with photos, manufacturer specifications, and local code requirements to justify the additional costs for items such as:

- Local building code upgrades (ice and water shield, drip edge, etc.)

- Correct labor rates and overhead/profit for your specific market

- Disposal and cleanup fees

- Replacement of specific flashing, starter strips, and ridge caps

- Necessary ventilation adjustments

This process has helped our clients recover thousands of dollars that would have otherwise been out-of-pocket expenses. If you’re facing policy issues, our guide on what to do if your homeowners insurance dropped you offers further insights.

Step 5: Why Choose a Local Roofing Expert in Sugar Land, TX

When your home is damaged, the temptation to hire the first contractor who knocks on your door can be strong. However, choosing a true local expert is one of the most important decisions you’ll make for your roof insurance claim. Sienna Roofing is a trusted, established expert in Sugar Land and the greater Houston area, and our deep local knowledge is your greatest advantage.

The Dangers of ‘Storm Chasers’

After a major storm, out-of-state contractors, known as “storm chasers,” flood the area. They often offer low prices and quick work, but they come with significant risks:

- Lack of Local Knowledge: They don’t know local building codes, permitting processes, or how to work with Texas insurance adjusters.

- Subpar Workmanship: They often use lower-quality materials and inexperienced crews to maximize profit.

- No Accountability: Once they’re paid, they leave town. If your roof fails a year later, their phone number is disconnected, and their “warranty” is worthless.

- Red Flags: Be wary of anyone demanding a large upfront payment, pressuring you to sign a contract on the spot, or offering to “cover” your deductible (which is insurance fraud).

The Sienna Roofing Advantage

- Experience with Texas Weather: We’ve worked through countless Gulf hurricanes, tropical storms, and severe Texas hailstorms. We know precisely what this weather does to a roof and how local insurance companies handle these specific types of claims.

- Mastery of Local Codes: Every city, from Sugar Land to Katy and Pearland, has specific building codes that must be followed. We ensure your roof replacement meets or exceeds all requirements (like Fort Bend County’s windstorm regulations) and that any necessary code upgrades are properly documented and included in your claim.

- Fast Emergency Response: As a local company, we’re already here when disaster strikes. We can provide immediate emergency tarping and repairs within hours, preventing further water damage while you wait for your claim to be processed.

- Community Commitment: We are proud to serve our neighbors in Sugar Land, Missouri City, Katy, Richmond, Pearland, Rosenberg, Rosharon, Friendswood, Webster, Bellaire, and West University. We’re not just a business; we’re part of the community. Our reputation is built on trust and long-term relationships, not quick storm profits.

Sienna Roofing

17034 University Blvd, Sugar Land, TX 77479

Click to call: (832) 564-3322

Frequently Asked Questions About Roof Insurance Claims

As a roofing contractor serving the Sugar Land area for years, we’ve answered countless questions about the roof insurance claim process. Below are answers to the most common and critical concerns we hear from homeowners.

How long do I have to file a roof claim after a storm in Texas?

In Texas, the statute of limitations for property damage claims is generally two years from the date of the event. However, your insurance policy is a contract that likely requires you to report damage much sooner. Most policies include language requiring you to provide “prompt notice,” often interpreted as within 60-90 days, and to file a formal claim within one year. Waiting is extremely risky; it makes it harder to prove the damage was “sudden and accidental” from a specific storm and can give the insurer grounds to argue you failed to mitigate further damage, potentially leading to a denial.

Will filing a claim for roof damage raise my insurance premium?

It’s possible, but not guaranteed. Insurers are more concerned with claim frequency (multiple claims in a few years) than a single, isolated claim, especially one related to a widespread weather event. When a catastrophic event like a hurricane impacts an entire region, insurers often raise rates for everyone in that area, regardless of whether you filed a claim. They typically cannot single you out for a rate hike simply for using your policy as intended after a natural disaster. If the repair cost is significantly more than your deductible, the financial benefit of filing the claim almost always outweighs the small risk of a future premium increase.

Can my insurance company require me to use their preferred contractor?

Absolutely not. In Texas, and most states, it is illegal for an insurance company to force you to use their preferred contractor. You have the absolute right to choose your own contractor. While their “preferred” vendors may offer a streamlined process, their primary loyalty may be to the insurance company that gives them business, not to you. Choosing an independent, local roofer ensures you have an advocate working solely for your best interests. When vetting a roofer for your roof insurance claim, look for:

- A permanent, local office and years of service in your community.

- Proven experience and specialization in insurance claims.

- Proper licensing and full insurance coverage (General Liability and Workers’ Compensation).

- Positive online reviews and verifiable local references.

- Avoid “storm chasers” who appear after a storm with high-pressure tactics or deals that seem too good to be true.

What if my roof is old? Will insurance still cover it?

Yes, but the type of coverage you have becomes critical. If you have an RCV (Replacement Cost Value) policy, the age of the roof doesn’t prevent you from getting a full replacement, though some insurers may try to argue otherwise. If you have an ACV (Actual Cash Value) policy, the age directly impacts your payout. The insurer will heavily depreciate the value of the roof, leaving you with a much smaller check and a large out-of-pocket expense. Some insurers will even automatically switch a policy from RCV to ACV once a roof reaches a certain age (e.g., 15 years). This is why reviewing your policy annually is so important.

How does my mortgage company get involved with the insurance check?

If you have a mortgage, the insurance check will likely be made out to both you and your mortgage company. The lender has a financial interest in ensuring the home is repaired. You will need to endorse the check and send it to your mortgage company. They will then typically hold the funds in escrow and release them in stages as the repair work is completed and inspected. This process can be slow and bureaucratic, so it’s important to contact your mortgage company early to understand their specific procedures.

What is ‘matching coverage’ and do I have it?

‘Matching coverage’ ensures that if part of your roof, siding, or flooring is damaged, the insurance company will pay to replace non-damaged portions as well to ensure a uniform, matching appearance. Without it, you could end up with a new patch of shingles that doesn’t match the rest of your roof, hurting your home’s curb appeal and value. Texas regulations are favorable to homeowners on this issue, but having a specific matching endorsement in your policy is the best protection. A good contractor will fight for matching on your behalf as part of a complete repair.

Conclusion: Be Prepared—Don’t Steer Roof Insurance Claims Alone

Handling a roof insurance claim doesn’t have to be a stressful, solitary journey. As we’ve detailed, success hinges on three fundamental pillars: meticulous documentation, a deep understanding of your policy, and the advocacy of a trusted local professional. The process is intentionally complex, and insurance companies have teams of experts working to protect their financial interests. You deserve the same level of expertise in your corner.

You wouldn’t perform your own surgery or represent yourself in court, so don’t try to steer a complex financial claim worth tens of thousands of dollars without an expert on your side. The weather in the Houston Metro area will always be a formidable challenge, but you don’t have to face the aftermath alone.

At Sienna Roofing, we’ve helped countless Sugar Land and Houston-area homeowners transform frustrating, underpaid claims into successful, fully-funded roof replacements. We’re not just fixing your roof; we’re protecting your home, your investment, and your peace of mind. Don’t risk leaving money on the table or accepting less than you’re owed. Get the expert assistance you deserve for your roofing insurance claim and let us help you secure the fair, complete settlement you are entitled to.