Insurance claims storm damage: 4 Easy Steps Guide

Why Understanding Insurance Claims Storm Damage Matters After a Texas Storm

Navigating insurance claims storm damage can be an overwhelming and stressful experience, but arming yourself with the right knowledge can save you thousands of dollars and significant heartache. When severe weather strikes Texas, from the hurricane-prone Gulf Coast to the hail alleys of North Texas, you must act fast to protect your property and ensure your claim is handled correctly and fairly. For Houston area homeowners, who face a unique combination of threats from hail, high winds, and tropical systems, understanding this process is not just helpful—it’s an essential component of your financial security and peace of mind.

Quick Answer: Essential Steps for Storm Damage Insurance Claims

- Ensure safety first – Prioritize the well-being of your family. Check for immediate hazards like downed power lines, gas leaks, or structural instability before inspecting damage.

- Document everything – Take extensive photos and videos of all damage from multiple angles before any cleanup or repairs begin.

- Contact your insurer promptly – Most policies require swift notification. Report the damage as soon as it’s safe to do so.

- Make temporary repairs – Mitigate further damage by tarping your roof or boarding windows. This is often required by your policy. Save all receipts.

- Review your policy – Understand your deductible (especially if you have a separate, higher hurricane or wind/hail deductible), coverage types, and exclusions.

- Meet with the adjuster – Be present for the inspection to point out all documented damage. Consider having a trusted local contractor present as well.

- Get multiple estimates – Obtain detailed, written estimates from licensed, insured, and local contractors.

- Keep detailed records – Maintain a comprehensive file of all communications, reports, estimates, and receipts related to your claim.

The financial stakes are incredibly high. In 2023 alone, the U.S. experienced 28 separate billion-dollar weather and climate disasters, which collectively caused $93.1 billion in losses. Texas frequently leads the nation in the number of these costly events. With the average claim for hail and wind damage hovering around $12,913, meticulous documentation and a clear understanding of your policy are critical to avoiding a low settlement, a wrongful denial, or leaving thousands of dollars on the table.

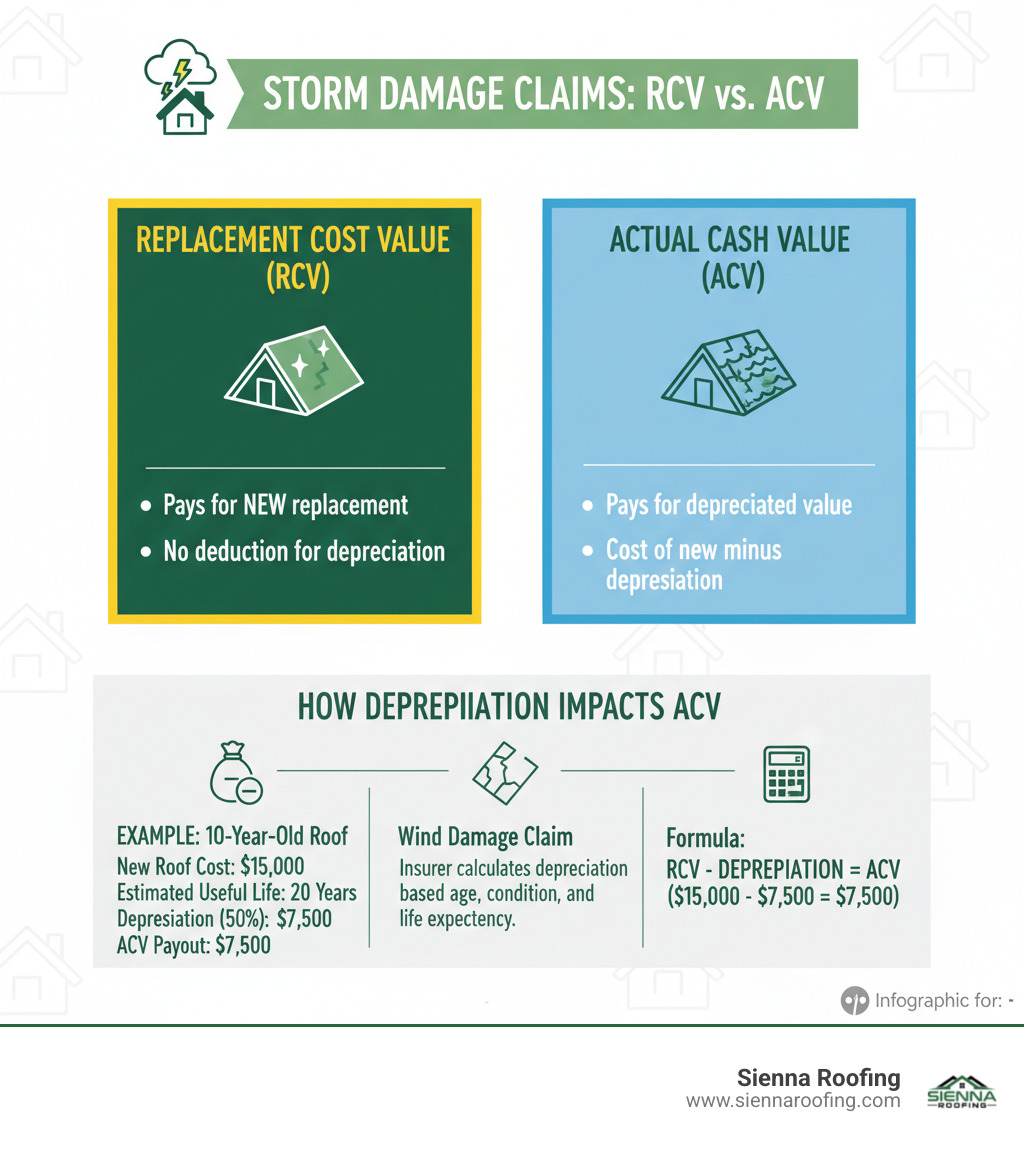

Most standard homeowners policies cover damage from wind, hail, and lightning. However, they almost universally exclude flood damage, which requires a separate policy. The timeline for receiving a payout can range from a few weeks to several months, largely depending on the complexity of the claim and the quality of your documentation. A pivotal detail is understanding the difference between Replacement Cost Value (RCV) and Actual Cash Value (ACV) coverage. RCV pays to replace your damaged property with new, similar materials, while ACV pays only the depreciated value. For a 10-year-old roof, that difference can easily amount to 40-50% of the total replacement cost, a gap you would have to cover out-of-pocket.

As Andre Castro, CEO of Sienna Roofing & Solar, I’ve spent years helping homeowners navigate this complex process. The pattern is clear: homeowners who are proactive, document damage thoroughly, and partner with reputable local contractors consistently achieve better, faster, and fairer claim outcomes.

This guide is designed to walk you through each critical step, empowering you to take control of your recovery. For immediate assistance with storm damage in the Houston area, explore our roofing storm damage repair services.

Step 1: Immediate Actions to Take After the Storm

The actions you take in the first 24 to 48 hours after a storm are foundational to the success of your insurance claims storm damage process. A calm, methodical approach during this chaotic time can make a significant difference in your final settlement. Follow these steps immediately after a storm passes over your Sugar Land, Missouri City, or Richmond home.

First and foremost, ensure everyone in your household is safe. Before you even think about the property, conduct a thorough safety check. Look for hazards like downed power lines (assume any downed line is live), listen and smell for gas leaks, and check for visible signs of structural damage like sagging ceilings or cracked foundation walls. If you suspect any immediate danger, evacuate the premises immediately and call the appropriate utility company or emergency services. Your safety is the absolute top priority.

Secure Your Property and Prevent Further Damage

Once you’ve confirmed the area is safe, your next mission is to prevent the existing damage from getting worse. This is known as “mitigating your loss” in insurance terms, and it’s a requirement in virtually all homeowners policies. Failure to take reasonable steps to protect your property can lead to the denial of claims for any subsequent damage.

- Emergency Tarping: If your roof has visible holes, missing shingles, or damage from a fallen tree, covering the area with a heavy-duty tarp is the most effective way to prevent water from entering your home. Water intrusion can lead to catastrophic damage to insulation, drywall, electrical systems, and promote the growth of mold, which can be a costly and hazardous problem on its own.

- Boarding Windows: Secure broken or shattered windows with plywood to protect your home’s interior from rain, wind, and security threats.

- Removing Debris: If it’s safe to do so, move small to medium-sized branches or debris off your roof or away from your home’s foundation to prevent further damage. However, for large trees or branches resting on your roof or near power lines, do not attempt to remove them yourself. Call a professional tree service immediately.

- Water Removal: If water has already entered your home, remove as much as you can with mops, buckets, or a wet-dry vacuum. Move wet furniture and rugs to a dry area and set up fans or dehumidifiers to start the drying process.

Crucially, save all receipts for any materials or services you purchase for these temporary repairs, such as tarps, plywood, or emergency water extraction. These costs are typically reimbursable as part of your claim. It is vital that you do not make any permanent repairs until your insurance adjuster has inspected the property and approved the scope of work. For detailed guidance, see our guide on how to handle roof storm damage repair.

How to Thoroughly Document Storm Damage

Documentation is the single most powerful tool in your insurance claims arsenal. Before you move a single branch or start any cleanup, use your smartphone to document the entire property like a crime scene investigator. The more evidence you collect, the stronger your claim will be.

- Photos: Take more photos than you think you need. Start with wide shots of each side of your house to establish context. Then, move to close-ups of every instance of damage: individual hail-dented gutters, cracked siding, broken window seals, and every missing or lifted shingle. For hail damage on a roof, place a coin or ruler next to the impacts to show scale. No detail is too minor.

- Videos: Create a narrated video walkthrough of your property, both inside and out. Slowly pan across damaged areas and verbally describe what you are seeing. For example: “This is the west-facing side of the roof, you can see multiple shingles have been lifted by the wind here. Now I’m in the attic, and you can see the water stain on the decking directly below that area.”

- Written Log: Start a claim journal. Note the date and time the storm occurred. Create a detailed, room-by-room list of all the damage you observe. This written record helps organize your thoughts and ensures you don’t forget anything when speaking with the adjuster.

- Home Inventory: For damaged personal belongings inside your home, create an inventory list. Include the item description, brand name, model number (if available), approximate age, and original purchase price. The National Association of Insurance Commissioners offers a helpful home inventory checklist that can serve as an excellent resource.

Do not throw away any damaged items, such as ruined furniture or sections of hail-damaged siding, until your adjuster has seen them or has explicitly told you that you can dispose of them. If you must remove something for safety reasons, document it extensively with photos first. The time you invest in meticulous documentation can translate directly into thousands of dollars in your final settlement.

Step 2: Decoding Your Policy: What’s Covered and What You’ll Pay

Your homeowners insurance policy is a complex legal contract that acts as your financial safety net. To navigate the insurance claims storm damage process effectively, you must understand its key components. Before you even file the claim, take the time to review your policy’s declarations page and relevant sections to understand your specific coverages, limits, deductibles, and exclusions.

One of the most critical distinctions to understand is Replacement Cost Value (RCV) versus Actual Cash Value (ACV). This single policy detail can mean a difference of tens of thousands of dollars.

- Replacement Cost Value (RCV): This coverage pays to repair or replace your damaged property with materials of similar kind and quality, without a deduction for depreciation. This is the superior form of coverage.

- Actual Cash Value (ACV): This coverage pays the replacement cost minus depreciation. Depreciation is the decrease in an item’s value due to age, wear, and tear.

Example: Imagine your 15-year-old roof is destroyed by a hailstorm. A full replacement costs $20,000. With an RCV policy, you would receive the full $20,000 (minus your deductible). With an ACV policy, the insurer might determine the roof had depreciated by 50% ($10,000). They would only pay you $10,000 (minus your deductible), leaving you to cover the remaining $10,000 yourself. Many RCV policies will first pay the ACV, and then pay the remaining amount (the “recoverable depreciation”) after you have completed the repairs and submitted the final invoice.

Understanding Your Deductible

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. For storm damage, you may have a different, higher deductible than your standard one. Look for a “Hurricane Deductible” or “Named Storm/Wind/Hail Deductible.” These are often calculated as a percentage (typically 1% to 5%) of your home’s total insured value (Dwelling Coverage), not a flat dollar amount. For a home insured for $400,000, a 2% hurricane deductible would be $8,000, a much higher out-of-pocket cost than a standard $1,000 deductible.

Storm Damage Typically Covered by Homeowners Insurance

Most standard Texas (HO-3) policies cover damage from common storm perils:

- Wind & Hail: This is the most common type of storm claim. It covers damage from high winds, tornadoes, and hail to your roof, siding, windows, and other structures. It accounts for nearly 40% of all homeowners claims, with an average payout of $12,913 in 2021. Learn more about identifying hail and wind damage to your roof.

- Lightning Strikes: Covers damage from direct lightning strikes, including fires and power surges that can destroy electronics and appliances. This peril causes about $1 billion in claims annually across the U.S.

- Fallen Trees: If a tree falls on an insured structure (your house, garage, or fence) due to wind or lightning, your policy typically covers the cost of removal and the repairs to the structure.

- Wind-Driven Rain: This is a nuanced coverage. Your policy generally covers interior water damage only if the wind first created an opening in the roof or walls (e.g., blew off shingles or broke a window) that allowed the rain to enter. Water seeping in without a wind-created opening is often not covered.

- Additional Living Expenses (ALE): Also known as “Loss of Use,” this is a crucial coverage if your home becomes uninhabitable due to a covered peril. It reimburses you for the extra costs of living elsewhere, such as hotel bills, restaurant meals, and laundry services, while your home is being repaired.

Common Exclusions and Necessary Add-Ons

Just as important is what your policy doesn’t cover:

- Flood Damage: This is the most significant exclusion. Standard policies do not cover damage from rising water (floods, storm surge). You must have a separate policy from the National Flood Insurance Program (NFIP) or a private flood insurer. These policies typically have a 30-day waiting period, so you cannot buy it right before a hurricane makes landfall.

- Maintenance Issues: Insurance covers sudden and accidental damage, not gradual deterioration from neglect or wear and tear. An insurer may deny a claim if they determine the damage was caused by a pre-existing issue, like an old, poorly maintained roof.

- Anti-Concurrent Causation Clauses: This complex clause can allow an insurer to deny an entire claim if a covered event (like wind) and an uncovered event (like flooding) contribute to the damage at the same time. This is often invoked after hurricanes.

- Regional Windstorm Coverage: In 14 Texas coastal counties and parts of Harris County, homeowners may be required to purchase separate windstorm and hail insurance through the Texas Windstorm Insurance Association (TWIA) if they cannot obtain it through the private market. This hurricane damage coverage video provides additional context on these specialized policies.

Step 3: A Homeowner’s Guide to Navigating Insurance Claims for Storm Damage

Once your property is secure, your family is safe, and the initial damage has been thoroughly documented, it’s time to officially initiate your insurance claims storm damage process. This phase is all about clear communication, meticulous organization, and active participation as you work directly with your insurance company and their assigned adjuster.

The Step-by-Step Process for Filing Your Claim

Contact your insurance agent or the company’s claims hotline immediately, ideally within 24-48 hours of the storm. Most policies have a clause requiring “prompt notification.” When you call, have your policy number handy. Provide a clear, factual, and high-level description of the damage, referencing your notes and photos. Avoid speculating on the cause or extent of the damage; simply state the facts (e.g., “A severe hailstorm passed over my house on Tuesday night, and my roof, gutters, and siding appear to be damaged.”).

The insurance company will assign you a claim number—guard this number, as it will be your primary reference for all future communication. They will also assign an adjuster to your case and schedule a time for them to come inspect the property. From this moment forward, keep a detailed log of every interaction. In your claim journal, note the date, time, the name of the person you spoke with, and a summary of the conversation. This organized record is invaluable if disputes or delays arise. For state-specific advice, the Texas Department of Insurance offers helpful claim filing tips on its website.

The Role of the Adjuster in Your insurance claims storm damage

The insurance adjuster is a professional trained to investigate property damage and estimate the cost of repairs according to the terms of your policy. It’s crucial to understand their role: the adjuster sent by your insurance company works for and is paid by the insurance company. Their job is to close the claim efficiently and according to their company’s guidelines. While most are professional, their goal is not necessarily to maximize your payout.

This is why it is absolutely critical that you be present for the adjuster’s inspection. Do not let them inspect the property alone. Prepare for this meeting:

- Have a Professional Partner: If possible, have your chosen local roofing contractor meet the adjuster at your home. A qualified contractor can speak the adjuster’s language, point out damage using industry-standard terms, and ensure the scope of work is accurate and complete. This is one of the most effective strategies for ensuring a fair initial assessment.

- Lead the Tour: Walk the adjuster through the property yourself. Using your photos and notes, point out every single detail of the damage you documented, both outside and inside. Don’t assume they will see everything. Point out the dented air conditioning fins, the cracked window beads, the water spot in the closet, and the hail-damaged fence.

- Provide Your Evidence: Give the adjuster copies of your documentation, including photos and any estimates you have already received from contractors. Ask for a copy of their final report and damage estimate (often called a “scope of loss”).

After the visit, the adjuster will submit their report and estimate to the insurance company, which will then use it to calculate your settlement offer. Remember, this initial assessment is a starting point for negotiation, not the final word. Our roofing insurance claims guide offers more in-depth strategies for managing the adjuster meeting and achieving a successful claim.

Step 4: After the Offer: Settlement, Repairs, and Avoiding Scams

Receiving the settlement offer for your insurance claims storm damage is a major milestone, but it’s not the end of the process. You must review this document with a critical eye. It will detail the approved repairs, the estimated costs, and the amount of your check. It is not a take-it-or-leave-it proposition; you have the right to negotiate if the offer is insufficient to restore your home to its pre-storm condition.

What to Do if You Disagree with the Settlement

If the initial offer seems too low to cover the repairs quoted by your trusted contractor, do not cash the check and do not feel pressured to accept it immediately. Take these measured steps:

- Compare Scopes of Work: The most important step is to compare the adjuster’s report (their “scope of loss”) line-by-line against the detailed estimate from your contractor. Look for discrepancies. Did the adjuster miss certain damaged items? Did they price for a lower quality material? Did they omit necessary labor steps like removing the old roofing material?

- Request a Re-Inspection or Supplement: Formally request a re-evaluation in writing. Provide your contractor’s detailed estimate and photos as evidence to support your position. Often, a contractor can file a “supplemental claim” directly with the insurer to account for items missed in the initial inspection or for costs that arise during the repair process.

- File a Formal Appeal: If informal discussions and supplemental requests fail, you can file a formal appeal with your insurer’s internal appeals department. Your appeal should be a professional letter that clearly outlines each point of disagreement and includes all supporting documentation.

- Consider a Public Adjuster: For large, complex, or persistently undervalued claims, hiring a public adjuster can be a game-changer. A public adjuster works directly for you, the policyholder, to manage the claim and negotiate a fair settlement. They are experts in policy language and claims negotiation.

- Contact State Authorities: As a final resort, you can file a formal complaint with your state’s department of insurance. They can investigate whether your insurer has handled your claim in bad faith or violated state laws.

The Payment Process: Navigating Checks and Mortgages

If you have an RCV policy, you will likely receive payment in at least two installments. The first check will be for the Actual Cash Value (ACV) of the damage. The remaining amount, the “recoverable depreciation,” is paid after you submit proof (final invoices) that the repairs have been completed. Furthermore, if you have a mortgage on your home, the insurance check will likely be made out to both you and your mortgage company. This complicates the process. You will need to contact your mortgage lender’s loss draft department to understand their specific procedures for endorsing the check and releasing the funds. They may require inspections and various documents before they release the money to you or your contractor.

Choosing a Reputable Contractor and Avoiding Scams

After a major storm, your neighborhood will be flooded with contractors. Unfortunately, many of these are “storm chasers”—out-of-state outfits that follow storms, perform shoddy work using cheap materials, and then disappear, leaving you with a voided warranty and no recourse. Protect yourself by working with an experienced local roofing contractor and watching for these red flags:

- Unsolicited Door-to-Door Visits: Legitimate local contractors are usually too busy to solicit door-to-door.

- High-Pressure Sales Tactics: Be wary of anyone who pressures you to sign a contract on the spot.

- Requests for Large Upfront Payments: Never pay for the entire job upfront. A reasonable deposit is 10-30%, with further payments made as work is completed.

- Offers to Waive or Cover Your Deductible: This is a common scam and constitutes insurance fraud. It can jeopardize your entire claim and expose you to legal risk.

- Vague Contracts: Insist on a detailed contract that specifies materials, labor, timelines, and total cost.

Always verify a contractor’s physical business address, general liability insurance, and workers’ compensation coverage. Check their local references and online reviews. Our guide on finding a trustworthy roofer in Sugar Land can help you vet potential hires. Never sign your insurance check over directly to a contractor.

Frequently Asked Questions About Storm Damage Claims

As you work through the process of insurance claims storm damage, many questions and unique situations will arise. Having clear answers to these common concerns can help you make informed decisions and reduce uncertainty.

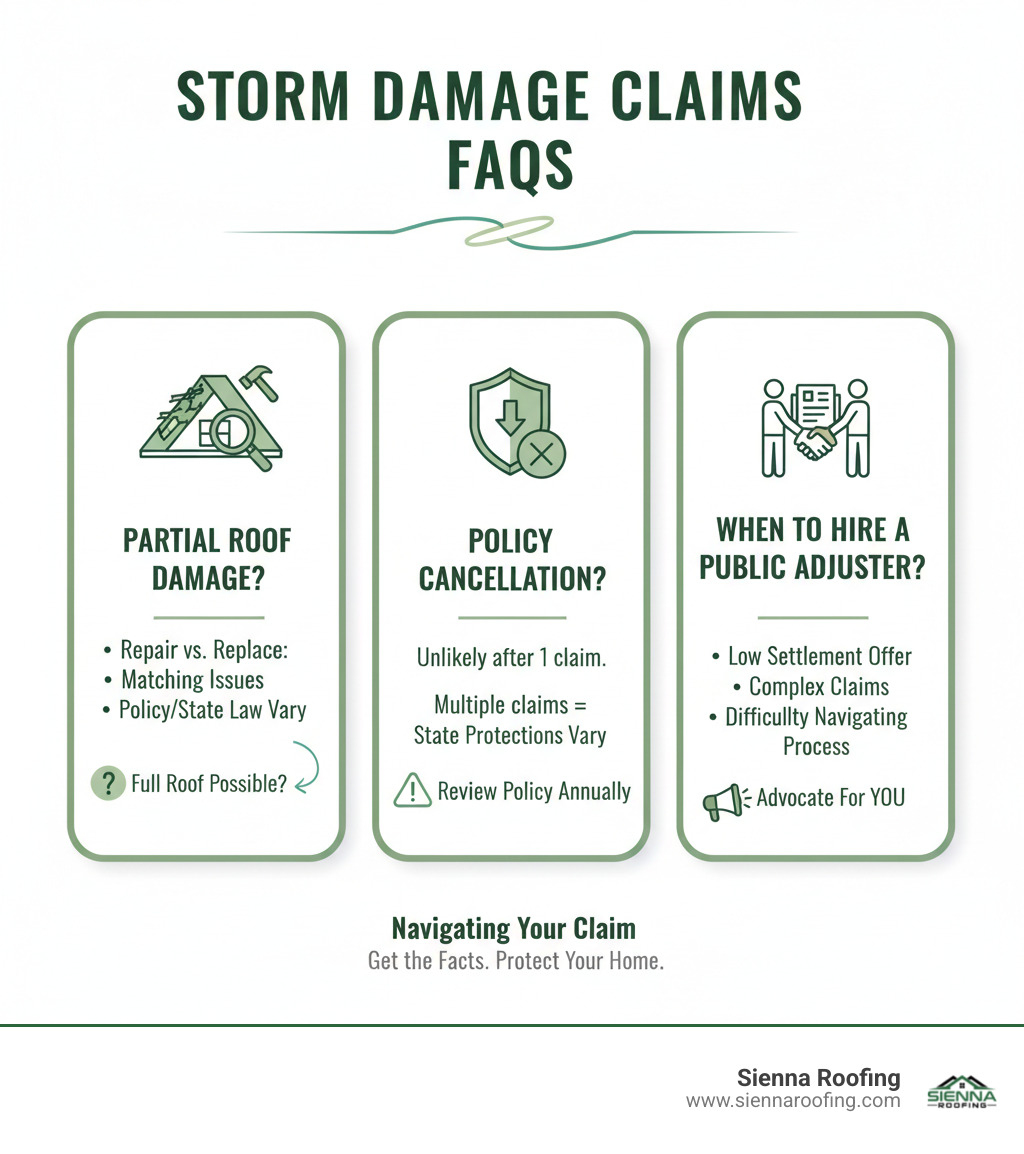

How do insurance companies handle claims if only part of my roof is damaged?

This is a very common point of contention. If a storm damages only one slope of your roof, the insurer’s initial obligation is to restore it to its previous condition. Their first offer may be to replace only the damaged section. This can create a “matching problem” if your existing shingles are weathered, faded, or have been discontinued by the manufacturer. The result is a mismatched, patchwork roof that significantly lowers your home’s curb appeal and resale value. In many cases, if a reasonable match is not available, you can successfully argue for a full roof replacement to ensure a uniform appearance and integrity. This often depends on your specific policy language and state laws regarding “matching.” A knowledgeable local contractor is essential in documenting the lack of a suitable match for hail damaged shingles.

Can my insurance company drop me after filing a storm damage claim?

While it is illegal for an insurer to drop you in the middle of a policy term for filing a single claim resulting from a natural disaster, they can choose to non-renew your policy when it comes up for renewal. Insurers track your claims history, and multiple claims in a short period (e.g., three claims in five years) can flag you as a higher risk. This could lead to higher premiums or non-renewal. In disaster-prone areas, insurers like the Texas Windstorm Insurance Association (TWIA) are particularly cautious. For this reason, it’s wise to file claims only when the repair costs significantly exceed your deductible.

When is it advisable to hire a public adjuster?

A public adjuster is an insurance professional who works exclusively for you, the policyholder, not the insurance company. They can be a powerful ally in specific situations. Consider hiring one if:

- Your claim is for large, complex, or widespread damage (e.g., a major fire or hurricane damage).

- The insurance company’s settlement offer is substantially and unreasonably low.

- Your claim has been outright denied, and you believe the denial is unfair or in bad faith.

- You simply lack the time, energy, or expertise to manage the demanding and complicated claims process effectively.

Public adjusters work on a contingency fee, typically charging a percentage (10-20%) of the final settlement. While this is an added cost, their expertise can often result in a significantly higher payout that more than covers their fee.

What is recoverable depreciation and how do I claim it?

If you have a Replacement Cost Value (RCV) policy, your insurer will often hold back a portion of the total settlement called “depreciation.” The first check you receive is for the Actual Cash Value (ACV). To get the rest of your money—the recoverable depreciation—you must first complete the repairs. Once the work is done, you submit the final, paid-in-full invoice from your contractor to the insurance company. They will then release the depreciation amount to you in a second check. It is crucial to follow through on this final step, as it can represent 30-50% of your total claim value.

How long does an insurance company have to respond to my claim in Texas?

Texas has specific laws, known as the Prompt Payment of Claims Act, that dictate how quickly insurers must act. According to the Texas Department of Insurance, once you file a claim, the insurer generally must:

- Acknowledge your claim and begin their investigation within 15 business days.

- Make a decision to approve or deny the claim within 15 business days after they receive all the information they need from you.

- Pay the claim within 5 business days after they have approved it.

If the insurer needs more time, they must notify you and can take an additional 45 days to make a decision. Knowing these timelines can help you hold your insurer accountable.

Conclusion: Restore Your Roof and Peace of Mind

The road to recovery after a storm can be long and fraught with challenges, but you do not have to walk it alone. Successfully navigating insurance claims storm damage is a manageable process when you are prepared. It hinges on four key pillars: prioritizing safety, committing to meticulous documentation, understanding the fundamentals of your insurance policy, and partnering with trusted, local professionals who can advocate on your behalf.

By taking an active and informed role in your own claim, you transform from a victim of the storm into the manager of your recovery. You are not just filing paperwork; you are taking the necessary steps to protect your most valuable asset, restore your home, and reclaim your family’s peace of mind. If you feel stuck, overwhelmed, or that your claim is not being handled fairly, remember that expert guidance can make all the difference in the outcome.

For homeowners in Sugar Land, Missouri City, and the greater Houston area, Sienna Roofing & Solar is ready to be your partner through every phase of storm recovery. We bring a deep understanding of both the technical requirements of high-quality roofing and the intricate nuances of the local insurance process. Our commitment is to provide durable repairs, transparent communication, and your complete satisfaction. Explore our comprehensive roofing storm damage repair services and let us help you restore not just your roof, but your security and stability after the storm.