Insurance Claim Assistance for Roofs: 1 Big Win!

Storm Just Hit? Do These 5 Steps Now to Protect Your Roof—and Your Insurance Payout

Act fast: document the damage, mitigate further loss, and notify your insurer immediately. Expert insurance claim assistance for roofs can dramatically improve outcomes. For quick, local guidance from trusted pros, start with our Houston roofing experts and follow this checklist to protect your claim and your home. Wind and hail are the most frequent homeowners insurance losses in the U.S., and the Insurance Information Institute reports average claim payouts typically exceed $12,000—so precision matters from the first step. Following the right process helps secure a full, timely settlement for your roofing insurance claim.

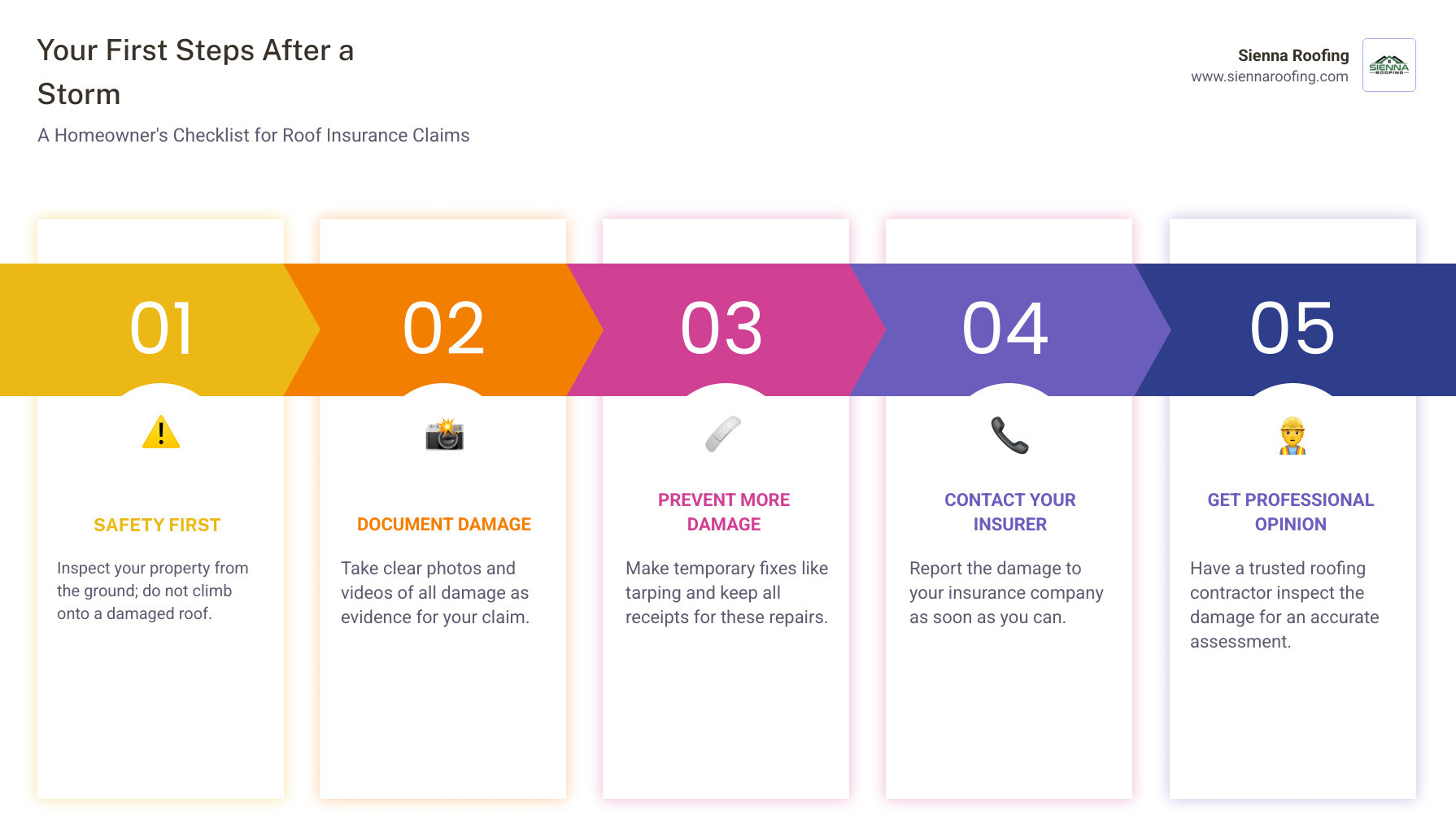

Here’s a quick guide to what to do first:

- Safety First: Check your property from the ground. Never climb onto a potentially damaged roof.

- Document Everything: Take clear photos and videos of all damage.

- Prevent More Damage: Make temporary fixes, like tarping, to stop further issues. Keep all receipts.

- Contact Your Insurer: Report the damage as soon as possible.

- Get a Professional Opinion: Have a trusted roofing contractor inspect the damage.

These actions significantly impact your claim. The Insurance Information Institute notes wind and hail claim severity commonly tops $12,000, underscoring the value of meticulous documentation and mitigation.

Identifying and Documenting Roof Damage

The most crucial first step is to identify and document all roof damage. Your safety is paramount, so always inspect from the ground or enlist a professional.

- Signs of Hail Damage: Look for random damage patterns, impact marks (bruises or indentations) on shingles, and granule loss. On wood roofs, hail can cause splits with sharp edges. Even minor hail damage can shorten your roof’s lifespan and lead to future leaks.

- Wind Damage Indicators: High winds can cause visible and hidden damage. Look for loosened, cracked, or missing shingles. Lifted or creased shingles indicate broken seals, leaving your roof vulnerable to water intrusion.

- Water Intrusion Signs: After a storm, check your attic for leaks, water stains on ceilings, or dampness. Water pooling on the roof can also indicate drainage or structural issues.

- Photo and Video Evidence: This is your strongest ally. Take clear, well-lit photos and videos of all damage, capturing both wide shots and close-ups. If possible, include an object for scale and time-stamp your files.

- Written Logs: Maintain a detailed log of the storm date, the damage you found, and its location. This provides a comprehensive record for your insurer.

- Keeping Receipts: If you make immediate, temporary repairs, keep all receipts. These expenses may be reimbursable as part of your claim.

For more insights into identifying storm damage, we recommend our guide on Hail and Wind Damage to Roof.

Making Emergency Repairs to Prevent Further Damage

Once you’ve documented the damage, your next priority is to prevent it from worsening. Insurance policies require homeowners to take reasonable steps to mitigate further damage.

- Emergency Tarping: This is the most critical immediate step. Tarping an open hole or compromised area prevents water from entering your home and causing extensive interior damage.

- Securing Loose Debris: Carefully remove loose tree branches or other debris from your roof if it’s safe to do so. Prioritize safety and avoid climbing on a damaged roof.

- Why Temporary Fixes Are Crucial: Temporary fixes show your insurer you are proactively protecting your property, which can positively impact your claim. Always keep receipts for materials and labor for these temporary repairs.

Decoding Your Policy: The Fastest Way to Know What Your Roof Claim Will Cover

Understanding your homeowners insurance policy is the first step to a successful claim. Most standard policies (HO-3) cover sudden and accidental damage from perils like wind and hail but exclude issues like floods or poor maintenance. Knowing the difference is key to getting the insurance claim assistance for roofs you deserve.

Covered vs. Non-Covered Roof Damage

Answer first: Sudden, accidental storm damage is typically covered; age, wear, and neglect are not. Wind, hail, fire, and falling debris are common covered perils. With wind and hail claims often averaging $12,000–$13,000 nationally, thorough documentation is critical. The Insurance Information Institute confirms wind and hail are among the most frequent causes of homeowners losses in the U.S.

Now for the common exclusions:

- Wear and Tear: Insurance covers sudden events, not the natural aging process. If your roof is simply old and deteriorating, your insurer won’t pay to replace it. Roof age absolutely affects insurance coverage.

- Lack of Maintenance: If an adjuster finds that damage resulted from neglect—like failing to clean gutters or ignoring obvious repairs—your claim may be denied. Regular maintenance is often a policy requirement.

- Floods and Earthquakes: These are almost universally excluded from standard policies and require separate coverage.

So, does homeowners insurance cover roof leaks? A leak caused by a sudden storm is typically covered. A slow drip from old, deteriorating materials is not. For more details, see our Roof Leak Repair Ultimate Guide.

Key Insurance Terms You Must Know

Speak the language of your policy to avoid leaving money on the table.

- Deductible: The amount you pay out-of-pocket before your insurance coverage begins. It typically ranges from $500 to $2,000 or is a percentage of your home’s insured value.

- Actual Cash Value (ACV): Your damaged roof’s current worth, accounting for age and wear (depreciation). An ACV payout will be significantly less than the cost of a new roof.

- Replacement Cost Value (RCV): Covers the full cost to replace your damaged roof with new, similar materials, without deducting for depreciation. Most professionals recommend RCV policies for comprehensive coverage.

- Depreciation: The decrease in your roof’s value over time due to age, wear, and tear. Insurers use formulas to calculate this.

- Open vs. Named Peril: An open peril policy covers all causes of loss unless specifically excluded. A named peril policy only covers losses explicitly listed. Most HO-3 policies provide open peril coverage for the home’s structure, which is good for your roof.

- Claim Settlement: The final amount your insurer agrees to pay. Professional insurance claim assistance for roofs can significantly impact this amount.

For a deeper dive into these terms, our complete guide to roof insurance claims walks you through every step.

| Feature | Actual Cash Value (ACV) | Replacement Cost Value (RCV) |

|---|---|---|

| Definition | Cost to replace damaged property minus depreciation (wear and tear, age). | Cost to replace damaged property with new materials of similar kind and quality, without deduction for depreciation. |

| Payout | Lower payout due to depreciation. | Higher payout, covers full cost of new materials and labor. |

| Out-of-Pocket | Homeowner pays deductible plus the depreciated amount. | Homeowner typically only pays the deductible (insurer may pay ACV first, then RCV upon completion of work). |

| Benefit | Lower premiums. | Higher reimbursement, ensures your roof is fully replaced/repaired to current standards. |

| Best For | Homeowners seeking lower premiums, or those with older roofs where RCV might not be available or practical. | Homeowners wanting complete coverage for a new roof, minimizing out-of-pocket expenses beyond the deductible. |

| Example | 15-year-old roof, 20-year lifespan. Insurer pays for current value of 15-year-old roof. | 15-year-old roof. Insurer pays for cost of brand new roof, less deductible. |

How Roofing Pros Supercharge Your Claim Outcome (And Keep It Code-Compliant)

When your roof is damaged, you need more than a repair crew; you need an advocate. A reputable roofing contractor is your most valuable ally, bridging the gap between you and your insurer. This professional insurance claim assistance for roofs is what turns a frustrating ordeal into a smooth process for homeowners in Sugar Land, Missouri City, and Richmond, TX.

How a Roofer Provides Insurance Claim Assistance for Roofs

A professional roofing contractor transforms your claim experience from overwhelming to manageable. Here’s how:

- Comprehensive Damage Inspection: A qualified roofer conducts a thorough examination of your entire roof system, searching for both visible and hidden damage to ensure nothing is overlooked.

- Detailed, Itemized Estimate: You’ll receive a clear, itemized estimate breaking down material quantities, labor charges, and work specifications. This level of detail is crucial for your insurance company.

- Meeting the Insurance Adjuster: Having your roofer present during the adjuster’s visit is a game-changer. They can point out all identified damage, preventing misunderstandings and ensuring an accurate assessment.

- Explaining Local Building Codes: Building codes change, and your insurer is typically required to cover the cost of bringing your roof up to current standards. Your roofer ensures these requirements are factored into your claim.

- Negotiating the Scope of Work: If the insurer’s initial assessment is incomplete, your roofer can negotiate on your behalf, providing additional documentation and expertise to ensure the settlement is fair and comprehensive.

Selecting the right partner is critical for a fair settlement. For more guidance, check our article on 7 Signs That a Roofing Company in Sugar Land is Trustworthy. The Louisiana Department of Insurance’s Storm New Roof Guide also offers valuable tips on avoiding scams.

Master the Adjuster Visit: What to Do Before, During, and After to Maximize Your Payout

The insurance adjuster’s visit is a critical moment for your claim. Being prepared and having a roofing expert present can prevent a lowball settlement and ensure you get the funds needed to restore your roof. This is your best opportunity to document the full extent of the damage.

Preparing for the Insurance Adjuster’s Visit

Answer first: Organize evidence, have your contractor present, and know your policy. This combination consistently leads to more accurate scopes and faster settlements.

- Have Documentation Ready: Organize all your evidence: photos, videos, written logs, and receipts for temporary repairs. A thorough and organized presentation makes your claim more credible.

- Schedule Your Contractor to Be Present: We can’t stress this enough. Having your roofing contractor present allows them to explain the technical details of the damage, advocate for a fair assessment, and ensure nothing is missed.

- Know Your Policy Details: Briefly review your policy to understand your coverage limits, deductible, and whether you have ACV or RCV coverage. This knowledge empowers you to discuss your claim confidently.

- Ask Questions: If anything the adjuster says is unclear, speak up. It’s your home and your claim, so ensure you understand every part of their assessment.

Understanding the full extent of your roof’s damage is crucial for effective insurance claim assistance for roofs. Being prepared for the adjuster’s visit is a major step toward a fair settlement.

What to Do If Your Claim is Denied or Undervalued

A denied or undervalued claim can be incredibly frustrating, but it’s not the end of the road. You have options.

- Request a Second Adjuster Visit: You can formally ask your insurance company to send a different adjuster for a fresh perspective on the damage.

- Hire a Public Adjuster: A public adjuster is an independent professional who works for you, not the insurance company. They negotiate on your behalf to maximize your settlement, typically for a percentage of the final amount.

- File an Appeal: Most insurers have a formal internal appeal process. You’ll need to submit a written appeal, often with additional documentation from your roofing contractor, explaining why the initial decision was incorrect.

- Use the Appraisal Clause: Many policies include an appraisal clause. If you and your insurer disagree on the loss amount, each side hires an appraiser, and they select a neutral umpire to make a final decision. This process can be binding.

- Consider Legal Action: If all other avenues fail, consulting an attorney specializing in insurance law may be your next step.

Specialized inspections, like those from organizations such as NRCIA, can provide forensic evaluations that are invaluable when challenging a denial. You can learn more about these specialized insurance claim inspections to see if this option is right for you.

Roof Insurance FAQs: Clear, Direct Answers to the Most-Asked Questions

Navigating a roof insurance claim raises many questions. At Sienna Roofing, we believe in empowering homeowners with clear answers about insurance claim assistance for roofs so you can feel confident in your decisions.

Can I choose my own roofing contractor?

Yes, it is your legal right to choose your own contractor. While your insurance company may suggest preferred providers, they cannot force you to use a specific company. The final decision is yours. We recommend partnering with a reputable, local company that has experience with insurance claims and works for you.

How much out-of-pocket cost should I expect?

Your primary out-of-pocket cost is your policy’s deductible. This is the amount you pay before your insurance coverage begins. Depending on your policy type (ACV vs. RCV), you may also be responsible for the depreciated value of your old roof. If you have an Actual Cash Value (ACV) policy, the insurer pays the current market value of your roof, factoring in age and wear. With a Replacement Cost Value (RCV) policy, you generally receive funds to replace the roof with new materials. Any upgrades you choose would also be an out-of-pocket expense.

Will filing a roof claim make my insurance premiums go up?

Filing a single claim, especially after a widespread weather event like a hailstorm, does not automatically mean your premium will increase. Insurers often classify these as an “act of God,” and your individual rates may remain stable. However, filing multiple claims in a short period can flag you as a higher risk, which could lead to rate hikes or non-renewal. For the most accurate information, it’s always best to discuss the potential impact with your insurance agent.

Get the Settlement You Deserve—And a Roof Built Right the First Time

Navigating a roof damage claim is complex, but you don’t have to do it alone. By understanding your policy, documenting all damage, and partnering with an experienced roofer, you can protect your home and ensure you get the fair settlement you deserve.

Sienna Roofing is proud to offer expert insurance claim assistance for roofs across the Houston area, guiding homeowners with integrity and proven expertise. We have a track record of helping homeowners successfully manage their insurance claims with clear communication and top-notch work.

If your roof has been damaged and you’re feeling overwhelmed, we’re here to help. Explore our latest resources to turn a stressful situation into a smooth restoration for your home.