Affordable home insurance claim assistance services: #1

Why Professional Claim Assistance is Crucial for Homeowners

When your home suffers damage, the insurance claim process should provide relief—but it often adds stress. You’re dealing with complex policy language, lowball settlement offers, and adjusters who work for the insurance company, not you. The good news is that professional claim assistance doesn’t have to drain your savings. For homeowners in the Houston Metro area, the expert guidance from a team like Sienna Roofing is the first step toward a fair recovery. Many experts work on contingency, meaning they only get paid if they increase your settlement.

Affordable home insurance claim assistance services connect homeowners with advocates who manage the process on their behalf. Here’s a breakdown of who can help:

| Type of Professional | What They Do | Typical Cost Structure |

|---|---|---|

| Public Adjuster | Documents damage, values loss, negotiates with insurer | 5-15% of final settlement (contingency) |

| Insurance Attorney | Handles denials, bad faith claims, legal disputes | Contingency or hourly ($200-$500/hour) |

| Specialized Contractor | Provides damage reports, repair estimates, meets with adjusters | Often free as part of repair service |

| Claim Consultant | Reviews policy, advises on strategy | Flat fee ($500-$2,000) or hourly |

I’m Andre Castro, founder of Sienna Roofing & Solar. My background in Construction Management and years of experience with Texas adjusters have shown me what it takes to level the playing field for homeowners. Understanding your options for affordable assistance is the critical first step toward a fair recovery, especially when dealing with roofing insurance claims.

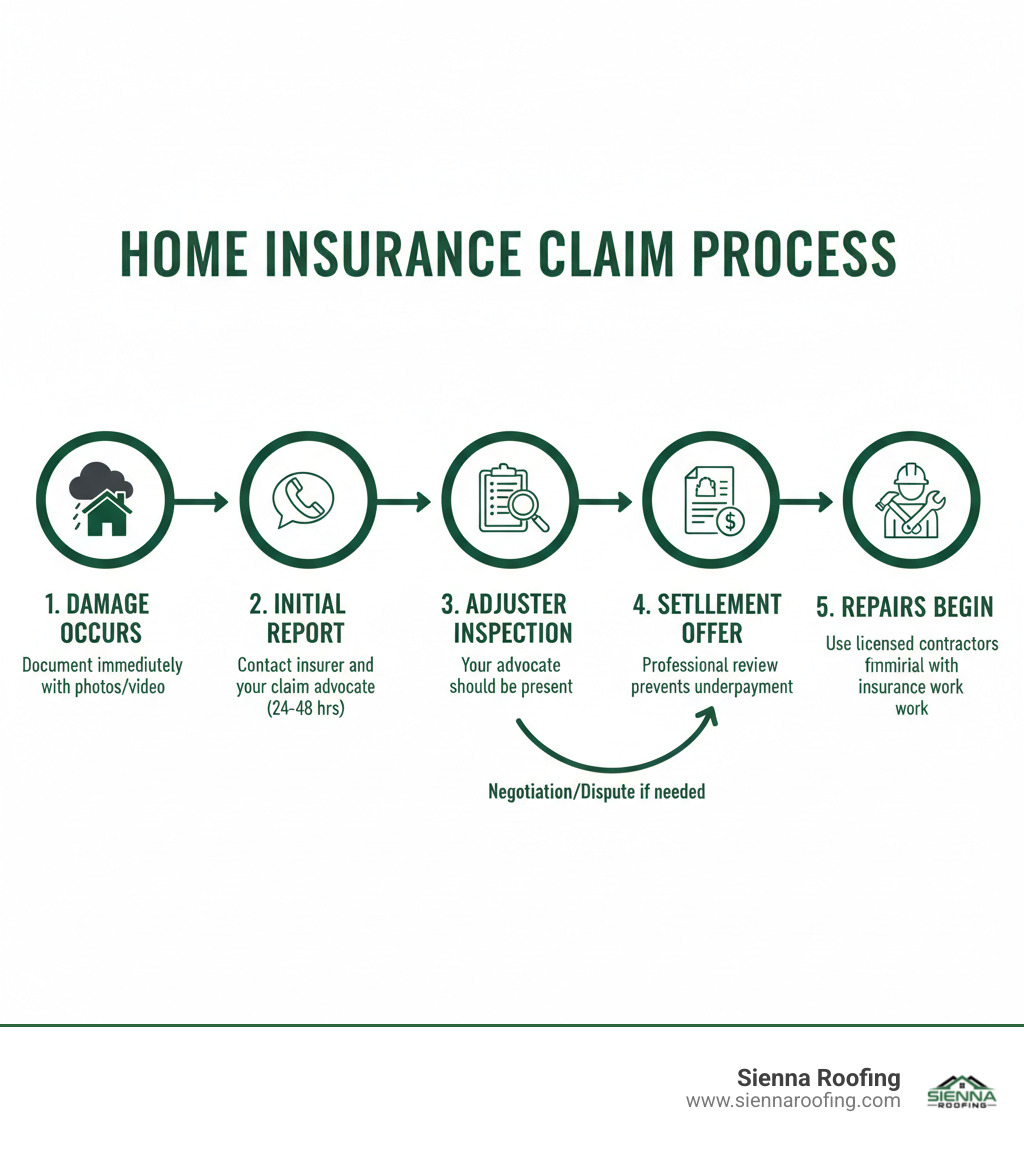

Infographic Description: A step-by-step visual flowchart displaying the 5 key stages of a home insurance claim process: (1) Damage Occurs – icon of storm cloud over house, (2) Initial Report – icon of phone call to insurer within 24-48 hours, (3) Adjuster Inspection – icon of clipboard inspector examining property, (4) Settlement Offer – icon of document with dollar amount, (5) Repairs Begin – icon of contractor with tools. Each stage includes a brief note: Stage 1 notes “Document immediately with photos/video,” Stage 2 notes “Contact insurer and your claim advocate,” Stage 3 notes “Your advocate should be present,” Stage 4 notes “Professional review prevents underpayment,” Stage 5 notes “Use licensed contractors familiar with insurance work.” Arrows connect each stage showing forward progression, with a side arrow from Stage 4 back to Stage 3 labeled “Negotiation/Dispute if needed.”

Your Claim Support Team: Who to Hire and Why

When disaster strikes, you don’t have to face the insurance company alone. The path to a fair settlement almost always involves a support team of professionals who understand the claims process. Each expert brings different skills—from documenting damage to fighting legal battles. Understanding who does what is the first step in assembling your team for affordable home insurance claim assistance services.

Public Adjusters: Your Damage Valuation Experts

A public adjuster is a state-licensed professional who works exclusively for you, the policyholder. Their sole responsibility is to advocate for your best interests and maximize your settlement. They manage your claim from start to finish by documenting your loss, calculating the true cost of repairs, and negotiating directly with your insurance company. For homeowners in Sugar Land with complex claims, a public adjuster ensures nothing is overlooked or undervalued.

Insurance Attorneys: Your Legal Shield

When a claim is wrongfully denied, drastically underpaid, or you suspect your insurer is acting in bad faith, an insurance attorney becomes your strongest ally. They provide the legal muscle needed to interpret your policy as a binding contract and protect your rights. An attorney is invaluable when disputes escalate, ensuring you have a champion who knows insurance law and will fight for the settlement you deserve.

Specialized Contractors: Your Repair & Claim Liaisons

Reputable contractors, particularly those specializing in storm damage restoration, play a vital supporting role. While Texas law prohibits contractors from acting as public adjusters, they provide detailed damage reports, create accurate repair estimates using industry-standard software, and meet with the insurance company’s adjuster to ensure all necessary repairs are included in the scope of work. At Sienna Roofing, we have years of experience documenting storm damage properly for adjusters throughout the Houston Metro area. Our detailed estimates ensure your claim covers the true cost of restoration, which can mean thousands of dollars difference in your final settlement.

How “Affordable” Claim Assistance Actually Works

When you’re facing unexpected repair costs, hiring professional help can seem daunting. However, many affordable home insurance claim assistance services are designed with zero upfront payment. The business model is built on a simple promise: to increase your settlement by more than their fee, putting more money in your pocket than you would get alone. If an insurer offers you $15,000 and a professional secures $30,000, you come out thousands of dollars ahead even after their fee.

Contingency Fees: “No-Win, No-Fee” Explained

This is the most homeowner-friendly payment structure and the standard for most public adjusters and many insurance attorneys. The professional takes a pre-agreed percentage (typically 5-15% for public adjusters) of the final claim settlement. The key benefit is that if they don’t secure you a settlement, you don’t pay their fee. This model aligns their success with yours, as they are incentivized to fight for every dollar.

Hourly Rates & Flat Fees

Some professionals offer hourly rates ($200-$500/hour) or flat fees ($500-$2,000) for specific tasks. This structure works well when you need targeted guidance rather than full claim management. For example, an attorney might review a denial letter, or a consultant might help you strategize your next steps. These fee structures offer predictability for homeowners who need expert insight at critical moments.

Finding Reputable and Affordable Claim Assistance Services

Finding a professional who delivers results is key. The cheapest option isn’t always the best value. To find truly affordable and effective help, follow these steps:

- Verify State Licensing: In Texas, public adjusters must be licensed by the Texas Department of Insurance. This is your primary protection against fraud.

- Read Testimonials: Look for providers with a proven track record in your area. Community trust is a strong indicator of quality.

- Demand a Written Contract: Before signing, get a detailed contract outlining all services, fees, and payment terms. A refusal to provide this is a major red flag.

- Use Non-Profit Resources: Organizations like United Policyholders empower homeowners by offering free guidance and directories of vetted professionals.

A 3-Step Roadmap to a Fairer Insurance Settlement

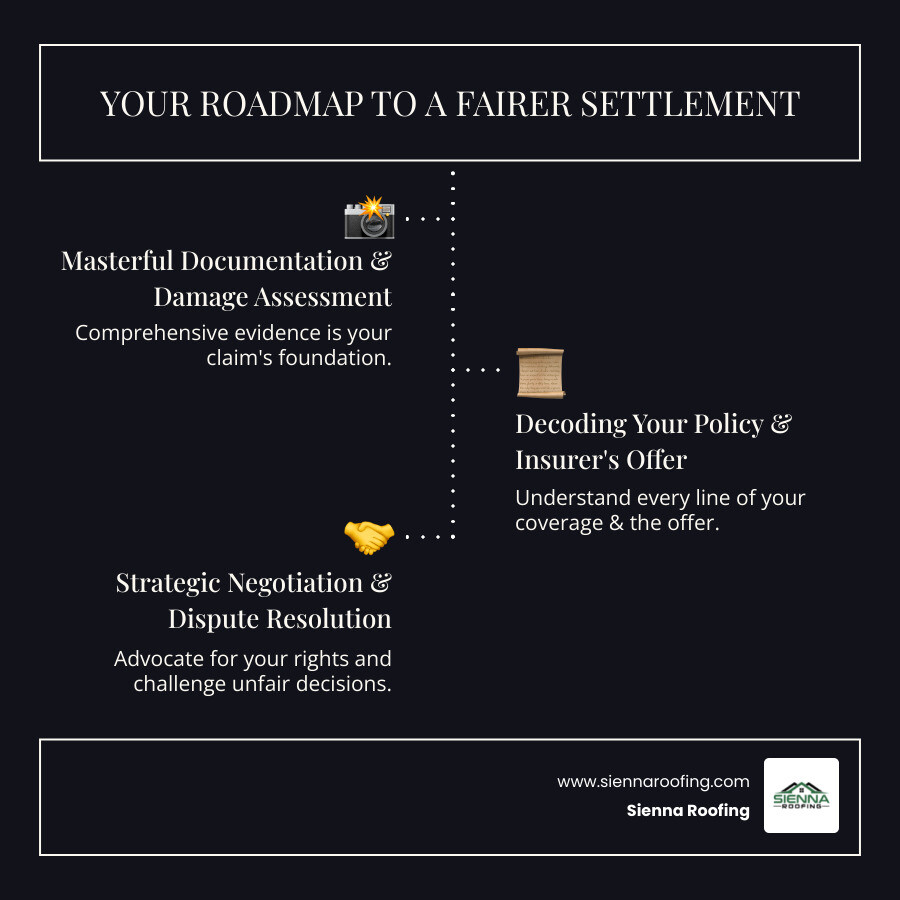

Infographic Description: A roadmap illustration with 3 key stops: (1) Masterful Documentation & Damage Assessment – icons of camera, clipboard, and magnifying glass, (2) Decoding Your Policy & Insurer’s Offer – icons of policy document, magnifying glass, and calculator, (3) Strategic Negotiation & Dispute Resolution – icons of handshake, gavel, and upward arrow. Each stop has a brief description: Stop 1 notes “Comprehensive evidence is your claim’s foundation,” Stop 2 notes “Understand every line of your coverage & the offer,” Stop 3 notes “Advocate for your rights and challenge unfair decisions.” Arrows connect the stops, guiding the viewer through the process.

Affordable home insurance claim assistance services transform the confusing claims maze into a clear, manageable path. Your professional advocate guides you through each critical step, turning a potential nightmare into a strategic process designed to get you every dollar you deserve.

Step 1: Masterful Documentation and Damage Assessment

The foundation of every successful claim is rock-solid proof. While your insurer sends their own adjuster, that person works to protect the insurer’s bottom line. Your advocate ensures a complete and accurate record of your loss. This includes gathering police or fire reports, documenting emergency repairs, and creating comprehensive inventory lists of every damaged item. As RBC Insurance emphasizes, visual records are the backbone of a strong claim. At Sienna Roofing, we use advanced technology like drones to capture high-resolution evidence from every angle, leaving no room for an insurer to dispute the extent of the damage.

Step 2: Decoding Your Policy and the Insurer’s Offer

Insurance policies are dense legal documents. Your claim assistance professional acts as your translator, turning confusing jargon into plain English. They clarify your coverages, limits, and deductibles, including the crucial difference between Actual Cash Value (ACV), which pays for depreciated value, and Replacement Cost Value (RCV), which covers the full cost to repair or replace. When the insurer’s initial offer arrives, your advocate scrutinizes every line item, identifying undervalued repairs and omitted work. This step prevents the common mistake of accepting a lowball offer out of confusion or exhaustion.

Step 3: Strategic Negotiation and Dispute Resolution

This is where your advocate truly earns their fee. If an offer is too low or a claim is denied, they manage the dispute process. This begins by presenting a counter-offer supported by compelling evidence, such as detailed contractor estimates and industry-standard pricing. If direct negotiation fails, your advocate can escalate the issue by filing formal complaints with the Texas Department of Insurance or other oversight bodies like Canada’s General Insurance OmbudService (GIO). They handle the confusing calls and intimidating letters, ensuring your voice is heard and your rights are protected until a fair resolution is reached.

Answering Your Top Questions About Claim Assistance

When considering affordable home insurance claim assistance services, it’s natural to have questions. Here are direct answers to the most common concerns we hear from homeowners in the Houston area.

Is it worth hiring help for a smaller home insurance claim?

It depends on the claim’s complexity, not just its monetary value. For a simple issue like a single broken window, professional help may not be cost-effective. However, many “small” claims hide larger problems, such as hidden water damage or issues matching discontinued materials. If your claim involves any complexity, a flat-fee consultation can provide significant value and peace of mind by clarifying your options before you commit to a full-service agreement.

Can my roofing contractor act as my public adjuster?

No. In Texas, it is illegal for a contractor to negotiate an insurance claim on your behalf unless they also hold a public adjuster license. This law, which prohibits the Unauthorized Practice of Public Adjusting, protects homeowners from conflicts of interest. However, an experienced contractor plays a vital supporting role. At Sienna Roofing, we provide detailed damage assessments, create accurate repair estimates using industry-standard software, and meet with the insurance adjuster to explain the necessary repairs and ensure nothing is overlooked. This advocacy for a proper scope of work is a critical part of a successful claim.

How do claim assistance services help with disputes?

They act as your professional equalizer when an insurer delays, underpays, or denies your claim. The process involves:

- Expert Analysis: Your advocate reviews the insurer’s decision against your policy and the evidence.

- Strategic Evidence: They compile a counter-case with contractor estimates, expert reports, and other documentation.

- Informed Negotiation: They engage directly with the insurer, using their knowledge of insurance law and industry practices to argue for a fair settlement.

- Formal Escalation: If needed, they file complaints with regulatory bodies like the Texas Department of Insurance to hold the insurer accountable.

How does technology help in getting a better settlement?

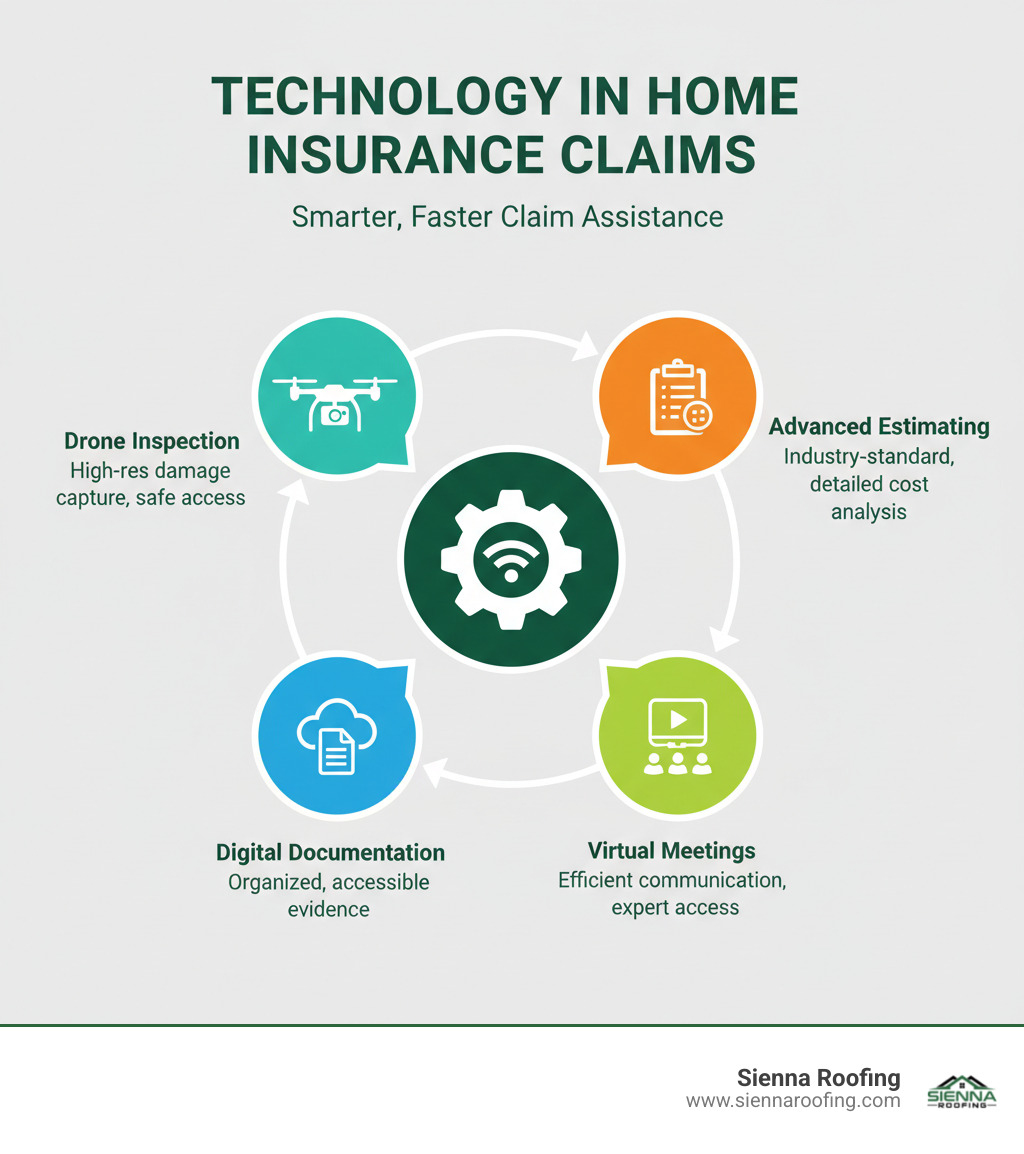

Infographic Description: A circular diagram representing “Technology in Claims Assistance.” Central icon of a gear with a Wi-Fi symbol. Surrounding it are four interconnected icons: (1) Drone Inspection – icon of a drone with a camera, (2) Xactimate Estimating – icon of a clipboard with a calculation symbol, (3) Digital Documentation – icon of a cloud with documents, (4) Virtual Meetings – icon of video call. Each icon has a brief benefit: Drone Inspection notes “High-res damage capture, safe access,” Xactimate Estimating notes “Industry-standard, detailed cost analysis,” Digital Documentation notes “Organized, accessible evidence,” Virtual Meetings notes “Efficient communication, expert access.” Arrows indicate the interconnected nature of these technologies.

Modern technology makes the claims process faster, more accurate, and more successful. Key tools include:

- Advanced Estimating Software: Programs like Xactimate create detailed, standardized estimates in the same language insurers use, making them difficult to dispute.

- Drone Technology: Drones capture high-resolution images of damage in unsafe or inaccessible areas, providing undeniable proof for roofing claims.

- Digital Documentation: Cloud-based platforms keep all your documents—photos, estimates, and correspondence—organized and easily accessible, speeding up the process.

- Virtual Communication: Video conferencing and online portals make expert assistance more accessible and allow for real-time updates on your claim’s progress.

Conclusion: Invest in Your Recovery and Peace of Mind

Navigating a home insurance claim is often stressful and overwhelming. However, by leveraging affordable home insurance claim assistance services, you do not have to manage it alone. Hiring professional help is an investment in both your financial recovery and your peace of mind.

From public adjusters to specialized contractors, affordable options exist to level the playing field. These experts bring invaluable knowledge and advocacy to your corner, ensuring your claim is handled correctly and negotiated strategically. This allows you to focus on what matters most—rebuilding your home and your life.

If your property damage involves your roof, partnering with a company that understands both construction and the insurance process is critical. The team at Sienna Roofing has extensive experience assisting homeowners in Sugar Land, Missouri City, and Richmond, TX. We are committed to providing the high-quality service needed for a successful recovery. Learn more about our roofing insurance claims assistance and let us help you get your home—and your life—back in order.

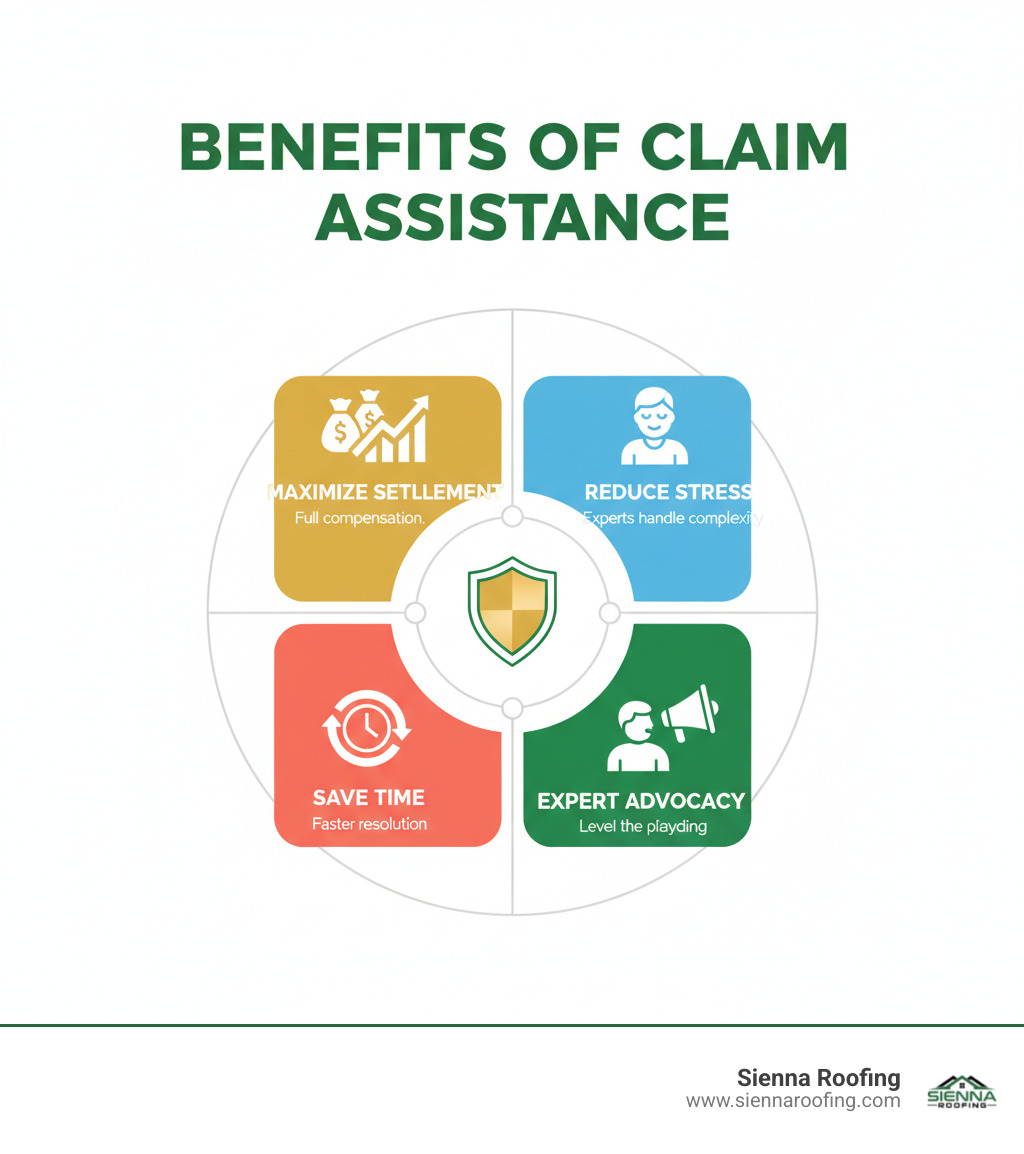

Infographic Description: A circular graphic titled “Benefits of Professional Claim Assistance.” At the center is a shield icon. Surrounding the shield are four benefits with corresponding icons: (1) Maximize Settlement – icon of growing money bags, (2) Reduce Stress – icon of a calm person, (3) Save Time – icon of a clock with an arrow, (4) Expert Advocacy – icon of a person speaking into a megaphone. Each benefit has a short descriptive phrase: Maximize Settlement notes “Ensure full compensation for all damages,” Reduce Stress notes “Let experts handle complex paperwork & calls,” Save Time notes “Streamline the claims process for faster resolution,” Expert Advocacy notes “Level the playing field against insurers.”