Insured roofing company: Secure Your 2025 Roof

Why Your Roofer’s Paperwork is as Important as Their Hammer

An insured roofing company protects you from financial disaster when things go wrong. It’s a statement that seems simple, but the implications are profound, especially in a place like Texas where your roof is constantly under assault from hail, hurricanes, and intense sun. When the inevitable damage occurs, the roofer you choose becomes a critical partner. Their skill with a hammer is obvious, but their diligence with paperwork is what truly shields you from unforeseen calamities. Here’s what you need to know to ensure you’re fully protected:

- General Liability Insurance: This is your primary shield against accidental damage. It covers property damage to your home or your neighbor’s, as well as injuries to third parties (like a visitor who trips over supplies). Without it, a simple mistake could lead to a complex lawsuit.

- Workers’ Compensation: This is non-negotiable. It protects you by ensuring that if a roofer is injured while working on your property, their medical bills and lost wages are covered by the insurance policy, not by a lawsuit against you.

- Commercial Auto Insurance: This policy covers the company’s vehicles and any accidents they might cause on or near your property. This is crucial, as a simple fender bender involving a work truck could otherwise become your legal headache.

- Certificate of Insurance (COI): This is the proof. You must always request and, more importantly, verify this document by calling the insurance provider directly. It’s your tangible evidence of their coverage.

- Licensed and Bonded: These credentials ensure the contractor has met state and local requirements to operate legally. A bond provides an extra layer of financial protection for you if the contractor fails to complete the job or meet their obligations.

Your roof is your home’s first line of defense against punishing Texas weather, but who defends you when the work is being done?

Choosing a roofer is a major decision. While you might focus on shingle types, color choices, and the final price, there’s a critical factor that can save you from financial disaster: insurance. It’s the invisible framework that supports the entire project.

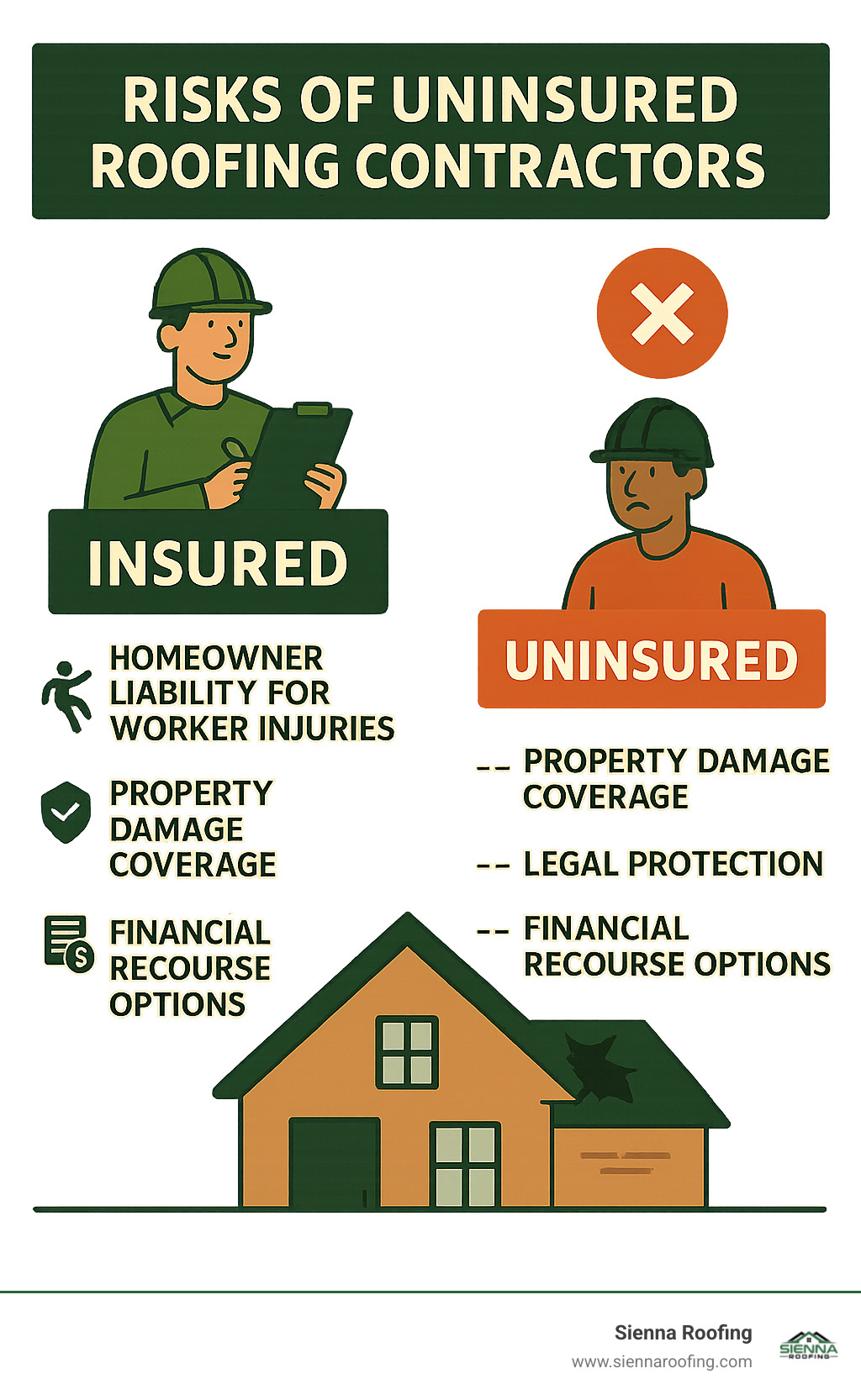

Hiring an uninsured contractor is a gamble you can’t afford to take. According to extensive research, homeowners can be held directly and personally liable for worker injuries and property damage when contractors lack proper coverage. The construction industry, and roofing in particular, has significantly higher injury rates than the national average, making robust insurance coverage even more crucial.

When you hire professional roofing contractors, you’re not just paying for shingles and labor. You’re investing in a comprehensive shield against lawsuits, staggering medical bills, and property damage that could easily cost tens of thousands of dollars, far eclipsing any initial savings.

This guide will walk you through everything you need to know about selecting a properly insured and certified roofing partner. You’ll learn how to verify credentials, understand the nuances of different types of coverage, and avoid the costly, stressful mistakes that come with cutting corners.

As Andre Castro, CEO of Sienna Roofing & Solar in Sugar Land, I’ve seen firsthand how choosing an insured roofing company makes the difference between a smooth, successful project and a financial and legal nightmare. With over five years of dedicated experience in the roofing industry and a background in Construction Management from Texas A&M, I’ve helped hundreds of homeowners navigate these critical decisions, ensuring their peace of mind is the top priority.

Find more about Insured roofing company:

The Non-Negotiable Insurance Policies Every Reputable Roofer Must Carry

When you’re searching for professional roofing services, understanding the specifics of insurance isn’t just helpful—it’s absolutely essential. An insured roofing company carries specific, distinct policies that create a multi-layered protective barrier between you, the homeowner, and potential financial disaster. These policies are the bedrock of a professional operation.

Think of it this way: a roofing project is a controlled chaos of heavy materials, powerful tools, and skilled workers navigating precarious heights, often 20 feet or more above the ground. The potential for accidents is always present. When something does go wrong, proper insurance is the sole factor that determines whether you sleep peacefully or spend sleepless nights consumed with worry about lawsuits, liens, and medical bills.

The three critical policies every legitimate roofer must carry are general liability insurance, workers’ compensation, and commercial auto insurance. These aren’t optional extras or negotiable add-ons; they are the fundamental pillars of responsible and ethical business practices. Without them, a contractor is not just cutting their own costs—they are transferring all the inherent risks of a dangerous job directly onto you, essentially gambling with your financial future.

Understanding General Liability Insurance

General liability insurance is your comprehensive safety net for the wide array of things that can go wrong around your property during a roofing project. This policy is designed to protect both you and the roofing company when accidents cause property damage or bodily injury to anyone who is not an employee of the contractor (they are covered by workers’ comp).

Picture these common scenarios: a roofer accidentally drops a bundle of shingles, and it crashes through your neighbor’s car windshield. Or perhaps a ladder slips and smashes your expensive outdoor kitchen grill and damages your landscaping. General liability coverage steps in to handle the costs of repair or replacement, plus any legal defense expenses if your neighbor decides to sue. It also covers things like a visitor tripping over a misplaced tool or a piece of debris left in the yard.

Coverage limits are a key detail to check. They typically range from $2 million to $5 million for reputable, established companies. This might sound like overkill, but a single serious accident involving significant property damage or personal injury could easily result in claims reaching hundreds of thousands of dollars. The higher the coverage limit, the better protected you are from catastrophic financial loss.

One crucial feature to look for within this policy is completed operations coverage. This is a vital extension that protects you even after the job is finished and the final check has been cashed. If problems arise from the completed work—for instance, improper flashing installation leads to a slow leak that causes significant water damage and mold growth months later—this coverage still applies to address the damages.

Why Workers’ Compensation is a Shield for Both Workers and Homeowners

Here’s a sobering fact that underscores the importance of this coverage: according to the Bureau of Labor Statistics, construction workers face injury rates significantly higher than most other industries. Roofing, with its unique combination of extreme heights, heavy materials, power tools, and exposure to unpredictable weather, is one of the most dangerous professions.

Workers’ compensation insurance is specifically designed to cover medical bills, lost wages, and rehabilitation costs when a roofer or any of their employees gets hurt on your job site. Without this specific coverage, an injured worker could, and often will, sue you directly as the property owner to recover these substantial expenses. The legal principle often applied is that the injury occurred on your property while work was being done for your benefit.

Imagine a roofer falls from a ladder and breaks their leg while working on your home. Without workers’ comp, you could be facing tens of thousands in medical bills, payments for their lost income while they recover, and your own legal fees to defend yourself in court. That “cheaper” quote from the uninsured contractor suddenly transforms into a devastating financial burden. It’s the single biggest risk a homeowner takes.

In Texas, workers’ compensation isn’t always mandatory for all businesses, which creates a dangerous loophole. However, any truly professional insured roofing company carries it without exception because it’s the right thing to do. The Texas Department of Insurance provides guidelines, but smart, ethical contractors always carry robust policies that exceed the minimum requirements to protect their team and their clients.

Finally, commercial auto insurance rounds out this essential trio. It covers the fleet of vehicles and specialized equipment that travel to and from your property. If a roofing supply truck backs into your garage door, damages your driveway, or is involved in an accident on your street related to the job, this coverage handles the costs, preventing claims against your personal auto or homeowner’s policy.

For more detailed information about navigating insurance issues during your roofing project, check out our comprehensive guide on roofing insurance claims.

The High Stakes of “Saving” Money: Risks of Hiring an Uninsured Roofer

We get it. You receive a quote from an uninsured roofer, and it’s hundreds—maybe even thousands—of dollars less than what a fully professional roofing company quoted you. Your first instinct is logical: “What a steal!” But here’s the hard, unvarnished truth: that initial “bargain” often becomes the single most expensive and stressful mistake a homeowner can make.

When you hire an uninsured contractor, you’re not just hiring a roofer; you’re personally assuming all the risks of one of the most dangerous jobs in construction. You are rolling the dice with your home, your savings, and your financial future. The risks are massive and multifaceted: crippling financial liability that could drain your retirement accounts, exhausting and emotionally taxing legal battles, direct conflicts with your own homeowner’s insurance policy, and shoddy, substandard workmanship with absolutely zero recourse. Beyond that, you could face fines for building code violations or even have the contractor abandon your project mid-way through, leaving your home exposed.

Think of it this way: an insured roofing company costs more upfront because they are making a significant annual investment in a safety net of protection for their workers, their business, and most importantly, for you. An uninsured contractor can offer those tempting rock-bottom prices precisely because they are operating without that protective umbrella, leaving you completely exposed to the storm.

The Financial Nightmare: When On-the-Job Accidents Become Your Problem

Let’s walk through a realistic scenario: An uninsured roofer, trying to rush before a storm, slips on a patch of wet plywood on your roof and falls, suffering a severe back injury. Suddenly, you’re not just dealing with an incomplete roofing project—you’re potentially facing a personal injury lawsuit that could cost you everything.

When a worker gets injured on your property and their employer lacks workers’ compensation insurance, the legal system often looks for the next responsible party. Guess who that is? You, the homeowner. The injured worker’s attorney will argue that you were negligent in hiring a contractor without proper insurance. Those medical bills for surgeries and physical therapy, the compensation for lost wages during a long recovery, and the damages for pain and suffering? They could all land squarely on your doorstep in the form of a lawsuit.

We’re not talking about small amounts here. A serious roofing accident can easily result in medical and legal costs exceeding $100,000 or more. To make matters worse, your homeowner’s insurance might refuse to cover these costs. Many policies contain clauses that exclude liability for injuries to workers if you knowingly hired an uninsured contractor, potentially voiding your policy right when you need it most.

The nightmare doesn’t stop with worker injuries. If that uninsured roofer accidentally causes damage to your neighbor’s property—say a gust of wind sends a sheet of plywood flying into their expensive sunroom—you could be on the hook for those repairs, too. Without the contractor’s commercial general liability insurance to act as a buffer, there’s no safety net between you and a financial disaster.

Shoddy Work and Ghosting: The Lack of Accountability

Beyond the immediate and terrifying liability issues, uninsured contractors often deliver work that’s as unreliable as their business practices. Why? Because a lack of insurance is a major red flag that often correlates with a lack of professionalism, licensing, and accountability. They have no reputation to protect and no insurance company or bonding agency holding them accountable for quality standards.

Here’s what typically happens: They use substandard or mismatched materials to keep their costs low, ignore critical local building codes because they aren’t properly licensed or trained, and cut corners on vital installation techniques like nail patterns and flashing. When your brand-new roof starts leaking six months later during the first heavy rain, their phone number is disconnected. They are nowhere to be found. No warranty, no callback, no responsibility.

Building code violations are particularly insidious and costly. These issues often don’t surface until a future home inspection—for instance, when you’re trying to sell your house. The inspector flags improper ventilation or nailing, and now you have to pay a reputable, insured contractor to tear out the bad work and do it all over again correctly. We’ve seen homeowners spend twice the original quote just to fix these botched jobs.

The most frustrating scenario? Project abandonment. Uninsured contractors often operate on a shoestring budget and juggle multiple jobs poorly. If they hit an unexpected snag on your roof or find a more lucrative gig across town, they might simply disappear, leaving your home exposed to the elements with half a roof. Good luck tracking them down for a refund or to finish the job.

When you work with an insured roofing company, you’re not just buying materials and labor—you’re buying accountability, reliability, and the peace of mind that comes from knowing you’re protected. To learn more about identifying trustworthy contractors, check out our guide on 7 Signs That a Roofing Company in Sugar Land is Trustworthy.

Your Due Diligence Checklist: How to Verify a Roofer’s Credentials

Now that you understand the immense risks of hiring an uninsured contractor, let’s focus on the practical steps to protect yourself. Verifying a roofer’s credentials isn’t just a smart suggestion—it’s an essential, non-negotiable step in safeguarding your home and finances. When you partner with professional roofing contractors, you’re investing in a team that values transparency and accountability. Think of this verification process as your personal insurance policy against fraud, shoddy work, and financial disaster.

The good news? Performing this due diligence is easier than you might think. You just need to know what to ask for, what to look for, and which red flags signal that you should walk away immediately.

How to Confirm a Roofing Company is Properly Insured

The Certificate of Insurance (COI) is your golden ticket, the single most important document in this process. It is a standardized form that proves the contractor has active insurance coverage. But here’s the critical part—a piece of paper can be forged. You must verify it independently.

- Start by requesting the COI from any contractor you’re seriously considering. A legitimate insured roofing company will provide this document promptly and without hesitation. If they make excuses, delay, or ask you to simply “trust them,” consider it a massive red flag and end the conversation.

- Call the insurance company directly to verify the policy is real, active, and has not been canceled for non-payment. The COI will list the name and phone number of the insurance agent or provider. This five-minute phone call is the most crucial step you can take and could save you tens of thousands of dollars in liability.

- Check the policy dates carefully. Ensure the coverage period extends through your entire project timeline. An expired policy is as worthless as no policy at all.

- Verify the coverage amounts are adequate. For General Liability, you want to see a “per occurrence” limit of at least $1 million, though $2 million is the standard for reputable companies. The “aggregate” limit, or total coverage for all claims in a year, should be at least double that. Don’t be afraid to ask what these terms mean.

- Confirm that Workers’ Compensation coverage exists and is listed. This is where many fly-by-night contractors cut corners, leaving you exposed to massive liability if a worker gets hurt. Ensure the policy is specifically for workers’ compensation.

- For larger or more complex projects, consider asking to be listed as an “additional insured” on their General Liability policy. This provides you with direct protection under their coverage and means their insurance company has a duty to defend you in a lawsuit. A truly professional contractor will accommodate this request.

Beyond Insurance: What Your Contract and Certifications Should Include

Insurance is the foundation, but it’s just the beginning. A truly professional roofing contractor will have all their paperwork in order, demonstrating a commitment to best practices across the board.

- Your written contract is your legal lifeline if a dispute arises. It must be detailed and spell out exactly what work will be done, the specific brands and types of materials to be used (e.g., “GAF Timberline HDZ shingles in Charcoal”), and a clear payment schedule. Never, ever accept a handshake deal or a contract scribbled on a napkin.

- The payment schedule deserves special attention. Be deeply suspicious of any contractor who demands a large upfront payment. A deposit of 10-30% is standard, but anything more than that is a major red flag. Professional contractors with stable finances understand that payment should follow project milestones.

- Lien releases are absolutely critical but are often overlooked by homeowners. A lien release is a document from the contractor stating that they have paid their suppliers and subcontractors for your project. Without signed lien releases, a supplier could place a lien on your property if your contractor fails to pay them, meaning you could end up paying twice for the same materials.

- Licensing verification takes just a few minutes but can save you from major headaches. While Texas doesn’t have a statewide roofing license, reputable contractors are often licensed by the Roofing Contractors Association of Texas (RCAT) or registered with local municipalities. Ask for their license number and verify it online.

- Surety bonds provide another powerful layer of protection. These bonds guarantee that if the contractor fails to complete the work properly or defaults on their obligations, you have financial recourse through the bonding company. While not always required, reputable contractors often carry them voluntarily as a sign of financial stability.

- Manufacturer certifications from major companies like GAF, Owens Corning, or CertainTeed are a mark of quality. They indicate the contractor has received specialized training in installing their products correctly and can often offer enhanced, extended warranties on materials that uncertified roofers cannot.

A truly professional insured roofing company will be proud to show you their credentials. They understand that transparency builds trust, and trust is the cornerstone of a successful project for everyone involved. At Sienna Roofing, we believe in complete transparency and are always ready to provide our full documentation for your review.

Sienna Roofing

17034 University Blvd, Sugar Land, TX 77479

(832) 564-3322

Is an Insured Roofing Company Worth the Extra Cost?

Let’s address the elephant in the room directly: yes, an insured roofing company will almost always cost more upfront than an uninsured one. You might see quotes that are 10-20% higher than those from the fly-by-night contractors who conveniently knock on your door right after a major hailstorm. Before you let that initial sticker shock sway your decision, it’s crucial to understand what you’re really paying for with that higher price tag.

The truth is, comprehensive insurance isn’t cheap for roofing companies, because roofing is classified as a high-risk industry. A full insurance package, including robust general liability and workers’ compensation policies, can cost a small roofing business anywhere from $500 to over $2,000 per month, and significantly more for larger operations with more employees. This necessary expense is factored into their overhead, just like the fuel for their trucks, the cost of high-quality tools, and the fair wages for their skilled, experienced workers.

But here’s the critical shift in perspective that many homeowners miss: this “extra” cost is not a fee, it’s an investment. It’s a direct investment in your own peace of mind and absolute financial protection. When you hire an insured contractor, you’re not just buying shingles, underlayment, and labor. You are purchasing a comprehensive safety net that protects you, your family, and your largest asset from potentially devastating financial liability.

Framed this way, the choice becomes clear: would you rather pay an extra $1,000 or $2,000 upfront for a fully insured, professional contractor, or risk being personally liable for a $50,000 medical bill if an uninsured worker falls off your roof? The premium for protection is minuscule compared to the potential cost of the risk.

Breaking Down the Cost: How Insurance Affects Your Roofing Quote

When you receive a quote from an insured roofing company, you’re seeing the true, all-in price of professionalism, stability, and risk management. That insurance premium isn’t just dead-weight overhead—it’s a clear indicator that the company is committed to operating legally, ethically, and with the highest regard for the safety of everyone involved in your project.

These insurance costs reflect several factors that directly benefit you as the homeowner. For example, companies with higher coverage limits pay more in premiums, but they also offer you far better protection. A contractor carrying $2 million in general liability coverage will have a slightly higher overhead than one with only a $500,000 policy, but that extra coverage could be the critical difference between full protection and personal financial disaster in a worst-case scenario.

The presence of insurance also indicates that the company has been thoroughly vetted by professional underwriters. Insurance companies don’t hand out policies to just anyone, especially in high-risk fields. They investigate a contractor’s safety record, claims history, business practices, and financial stability before agreeing to cover them. In essence, the insurance company has already done some of your due diligence for you.

Moreover, insured contractors are more likely to invest in other areas of professionalism that protect you. They invest in ongoing safety training and provide proper safety equipment like harnesses and guardrails, which reduces the likelihood of an accident happening in the first place. They also often have access to better materials and training programs. Many top-tier manufacturers require proof of insurance before they’ll certify a contractor, sell them premium materials, or authorize them to offer exclusive, extended warranties. This means your experienced roofing contractor can provide a higher-quality, longer-lasting roof system than their uninsured counterparts.

The small price difference you pay upfront pales in comparison to the enormous potential costs of hiring an uninsured contractor: crippling legal fees, life-altering medical bills, paying for damage to your or your neighbor’s property, and the cost of having to pay twice to fix substandard or incomplete work. When you look at it that way, insurance isn’t an extra cost—it’s the smartest, most valuable investment you can make in your roofing project.

Finding a Qualified Roofer in Your Area

When you’re ready to protect your home with superior workmanship and comprehensive insurance coverage, we’re here to help. At Sienna Roofing, we understand that choosing a roofing contractor is a significant decision, which is why we maintain full licensing and robust insurance coverage for every single project we undertake, without exception.

We’ve built our reputation in Sugar Land and the greater Houston area by combining deep local expertise with personalized, transparent service. Our team knows Texas weather patterns, the specific requirements of local building codes, and the unique challenges that come with roofing in our demanding climate. We’re not just another contractor passing through after a storm—we’re your neighbors, and we’re committed to being here for the long haul. Our goal isn’t just to install a roof—it’s to give you complete confidence and lasting peace of mind that your investment is protected every step of the way.

Conclusion: Invest in Certainty, Not Chance

Your roof isn’t just a collection of shingles and nails—it’s the guardian of your home, the symbol of your family’s security, and one of the most significant investments you’ll ever make in your property. When you’re choosing a roofer, you’re not just buying a service for a week; you’re making a critical decision that will impact your home’s safety, its market value, and your personal financial well-being for decades to come.

Here’s the fundamental truth: hiring an insured roofing company isn’t a luxury, an upgrade, or an unnecessary expense. It is as essential and non-negotiable as the foundation your house rests upon. The seemingly small difference in upfront cost between a fully insured professional and an uninsured handyman could be the very thing that saves you from financial ruin, legal battles, and unimaginable stress down the road.

Think about it in the simplest terms—would you drive a car without auto insurance or own a home without homeowner’s insurance? Of course not. The risk is far too great. The very same logic must be applied to your roofing project, which involves inherent dangers and high stakes. When you take the time to verify insurance coverage, check for proper licensing and certifications, and insist on a detailed written contract, you are actively building a fortress of safety around your most valuable asset.

Don’t gamble with your home. The horror stories of homeowners left facing massive medical bills, crippling lawsuits, and extensive property damage because they hired an uninsured contractor are devastatingly real. These aren’t rare, one-in-a-million occurrences—they happen in communities like ours more often than you’d think, turning a home improvement project into a life-altering crisis.

At Sienna Roofing, we’ve built our entire reputation on being the insured roofing company that homeowners in Sugar Land and beyond can trust completely and without reservation. We understand that your home represents security, comfort, and years of your hard work. That’s precisely why we carry comprehensive insurance coverage and maintain all proper certifications—because protecting your investment is just as important to us as it is to you.

Your home, your family, and your finances deserve certainty, not chance. When you’re ready to work with a roofing partner who puts your protection and peace of mind first, we’re here to help. Whether you’re in Sugar Land, the Houston Metro area, or surrounding communities like Missouri City, our dedicated team is committed to delivering exceptional service with complete transparency. Find a professional roofer in Missouri City and experience the profound difference that proper insurance and true professional expertise can make.

Don’t leave your biggest asset vulnerable to the whims of chance—invest in the certainty, security, and quality that comes with choosing the right, fully insured roofing partner.